Introducing the Figured Advisor’s Dashboard:

Model, monitor, and address risk & opportunity across your entire client portfolio

Farmers need agri advisors that can provide clarity in times of uncertainty.

Farmers always face uncertainty, it’s the nature of the business. But never more so than now with the current volatility in prices, costs and weather causing budgets to quickly become out-of-date.

For accountants, there is now even greater pressure to provide updated forecasts & budgets to as many of their clients as possible.

But it’s never been easy to pin-point those farmers who need your help the most.

This ad hoc approach is often disruptive to day-to-day workflows and ‘breaks the system’. It has firms providing these essential services to only those clients that request it or to an existing group of their top-end advisory clients - who aren’t necessarily the clients that need it the most.

THE NEW WAY

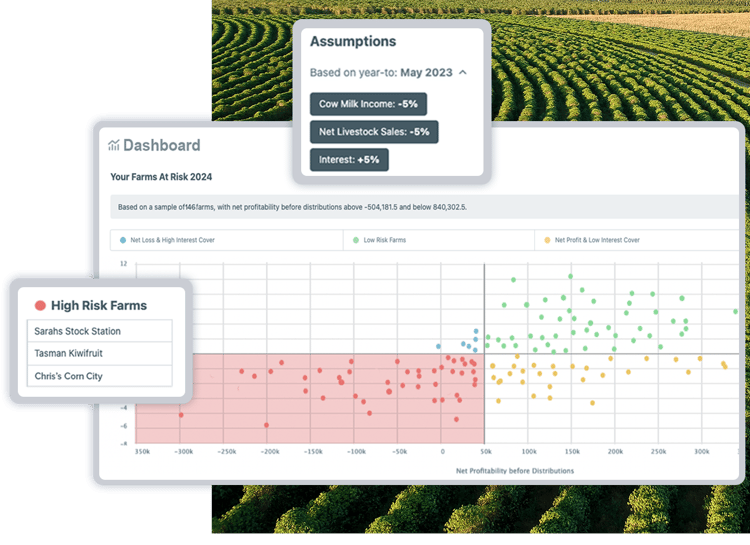

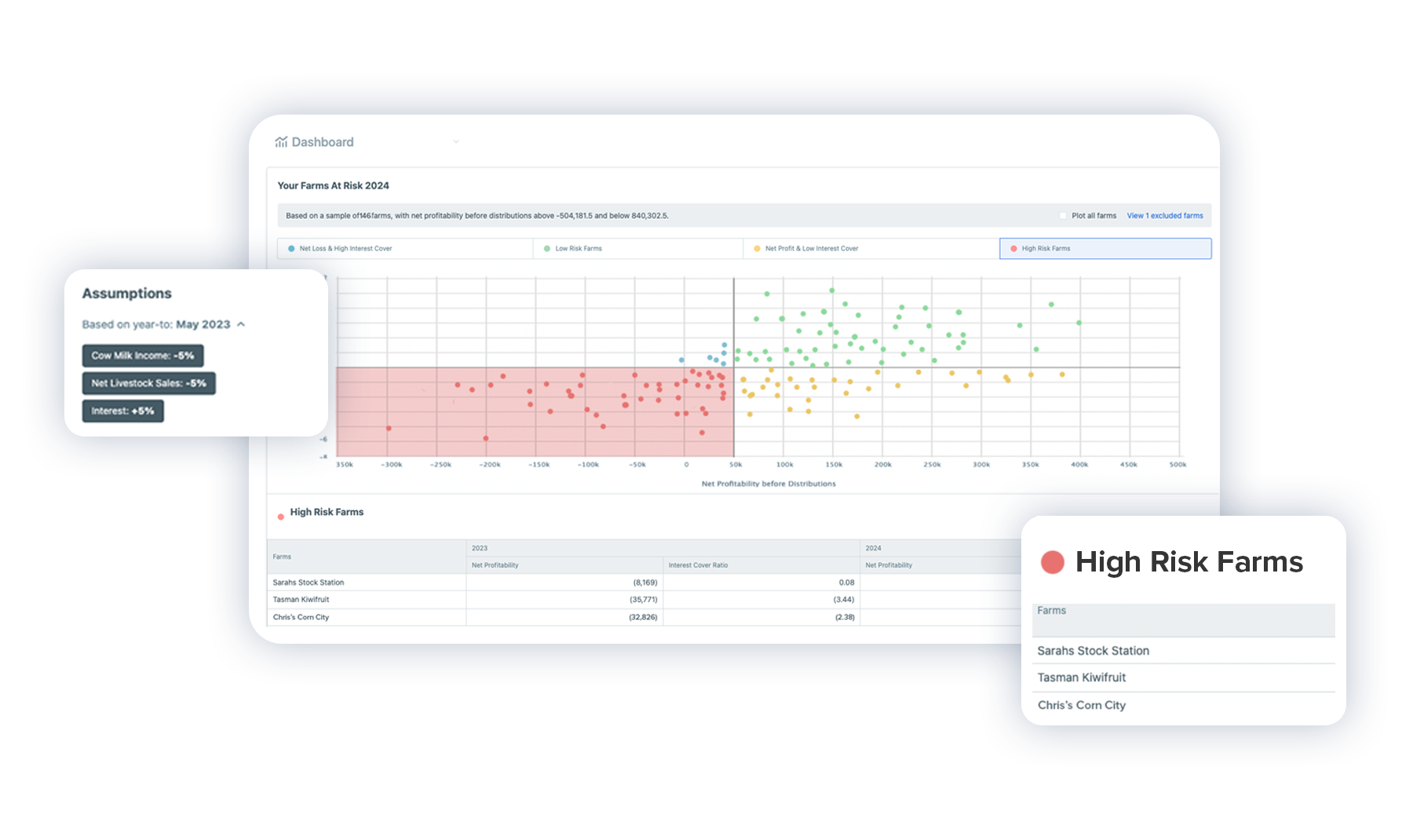

Agri firms can now model and monitor client risk & opportunity across their entire portfolio with the Figured Advisor’s Dashboard and get ahead of the game.

The Figured Advisor's Dashboard uses either farms’ actuals or forecast data and models outcomes using current or anticipated conditions.

When logging into Figured Insights, accountants can immediately identify:

- Clients are at risk of being unable to meet their interest payment obligations

- Clients faced with the ability to deleverage or to create opportunities through capital expenditure.

Accountants that can instantly identify their client’s risk & opportunity create more value.

By bringing a single, actionable issue to your client’s attention, you make that conversation more valuable for your client and your firm.

Discover

The Advisor’s Dashboard & Figured platform for all your agri services

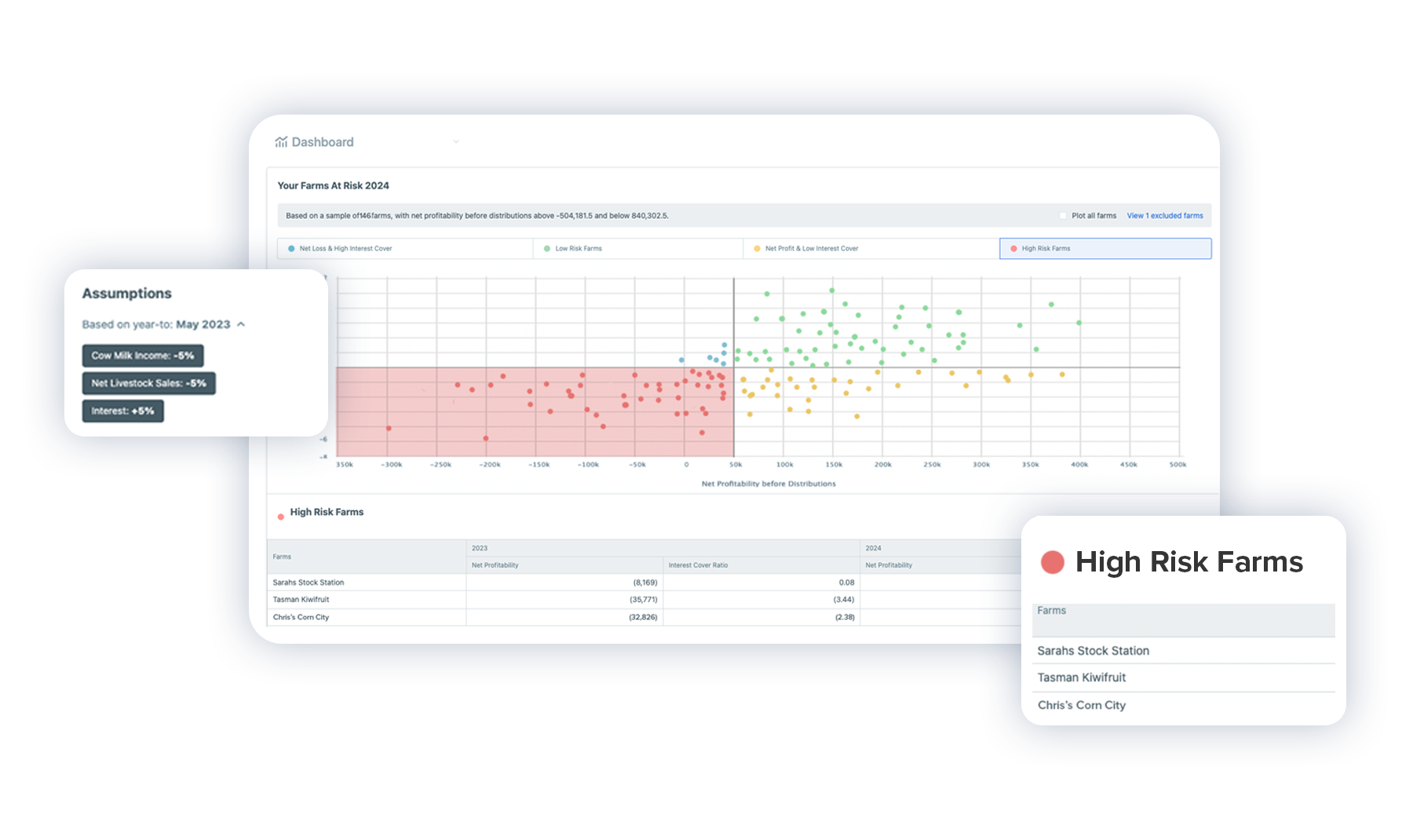

Figured Insights

Figured Insights

The ultimate practice tool for firms to unlock more value-added service opportunities.

- The Figured Advisor’s Dashboard: Monitor your entire client portfolio through a dashboard view to identify clients facing risk or opportunities.

- Model changes in dairy payouts or livestock prices across your portfolio and see which farms are most affected.

- Instantly see interest coverage ratios and identify those who are at risk.

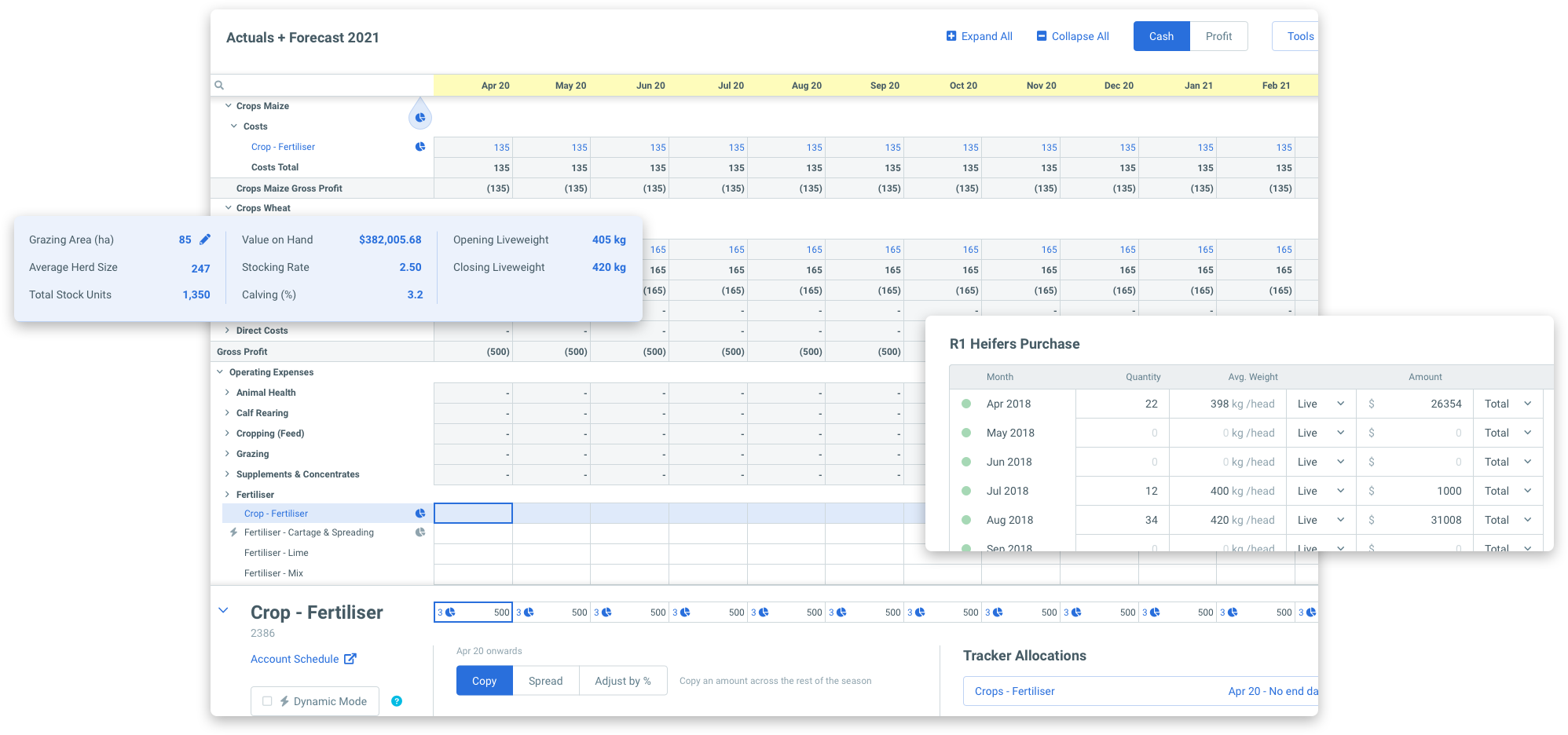

Farm Manager

Farm Manager

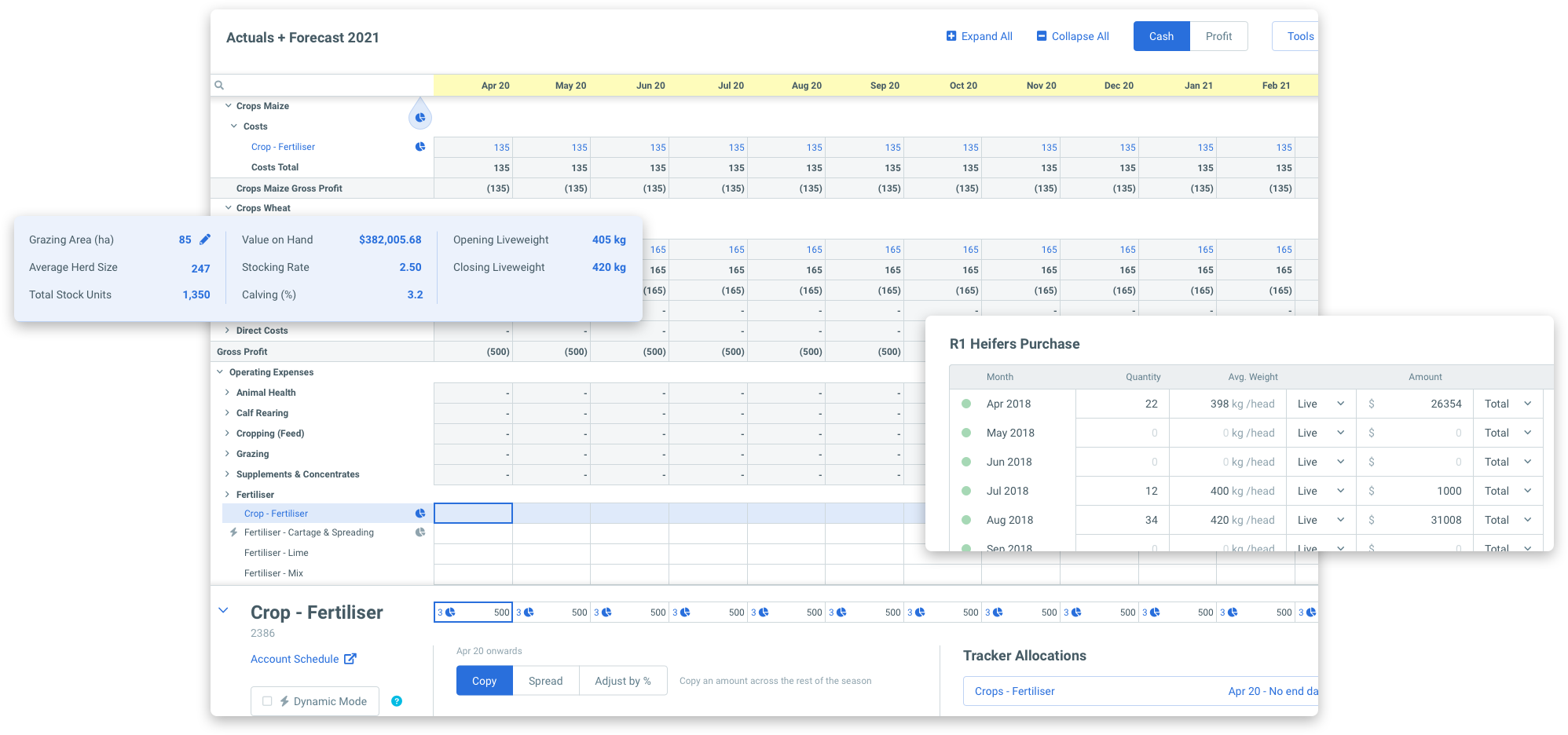

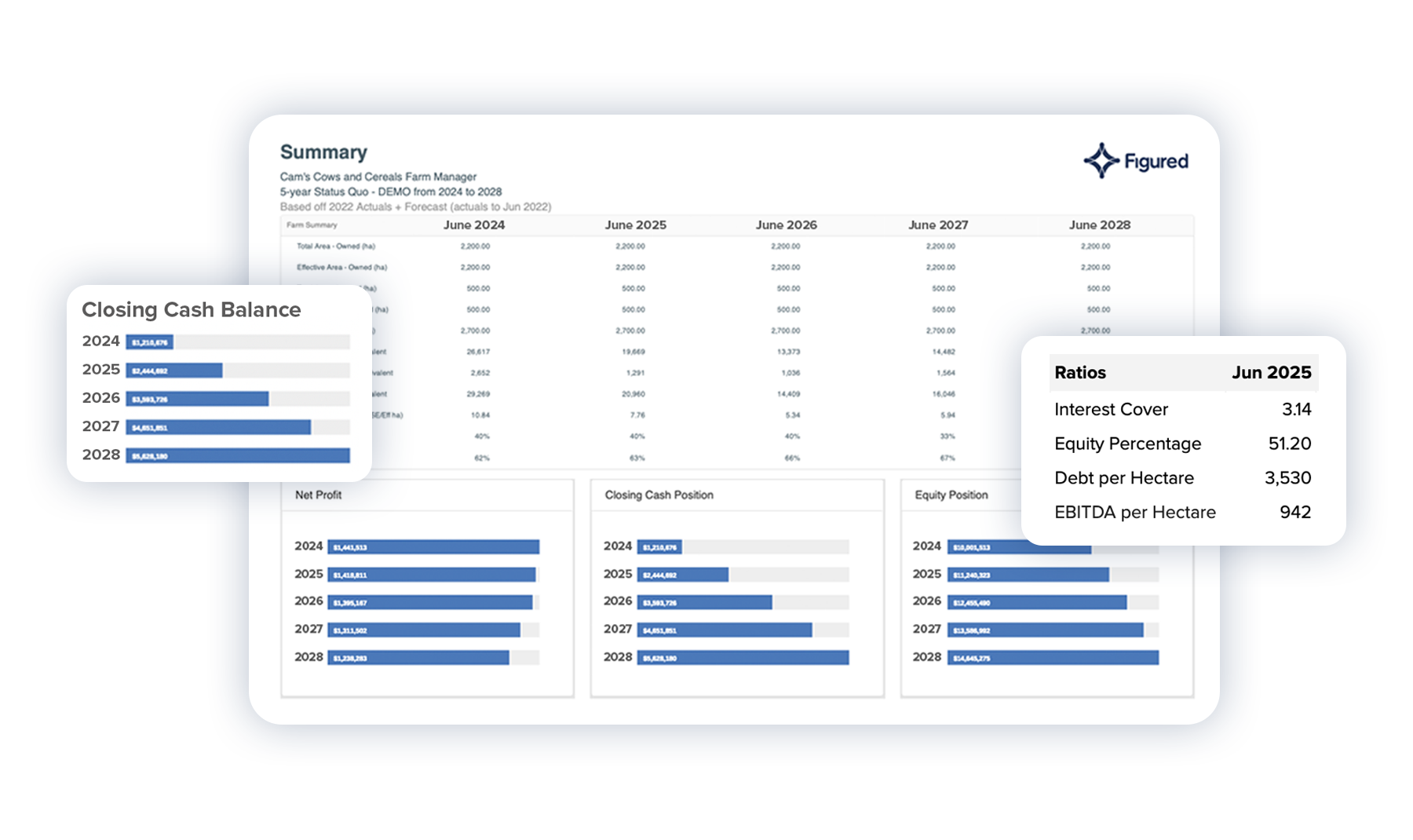

Powerful three-way forecasting to scale planning services across all your farming clients.

- Create a budget, forecast, and annual plan for your clients with up-to-date financial and production data.

- Monitor variance on an on-going basis, reforecast when needed, and make planning a year-round rather than one-off opportunity with your clients as conditions and on-farm performance changes.

Farm Reporter

Farm Reporter

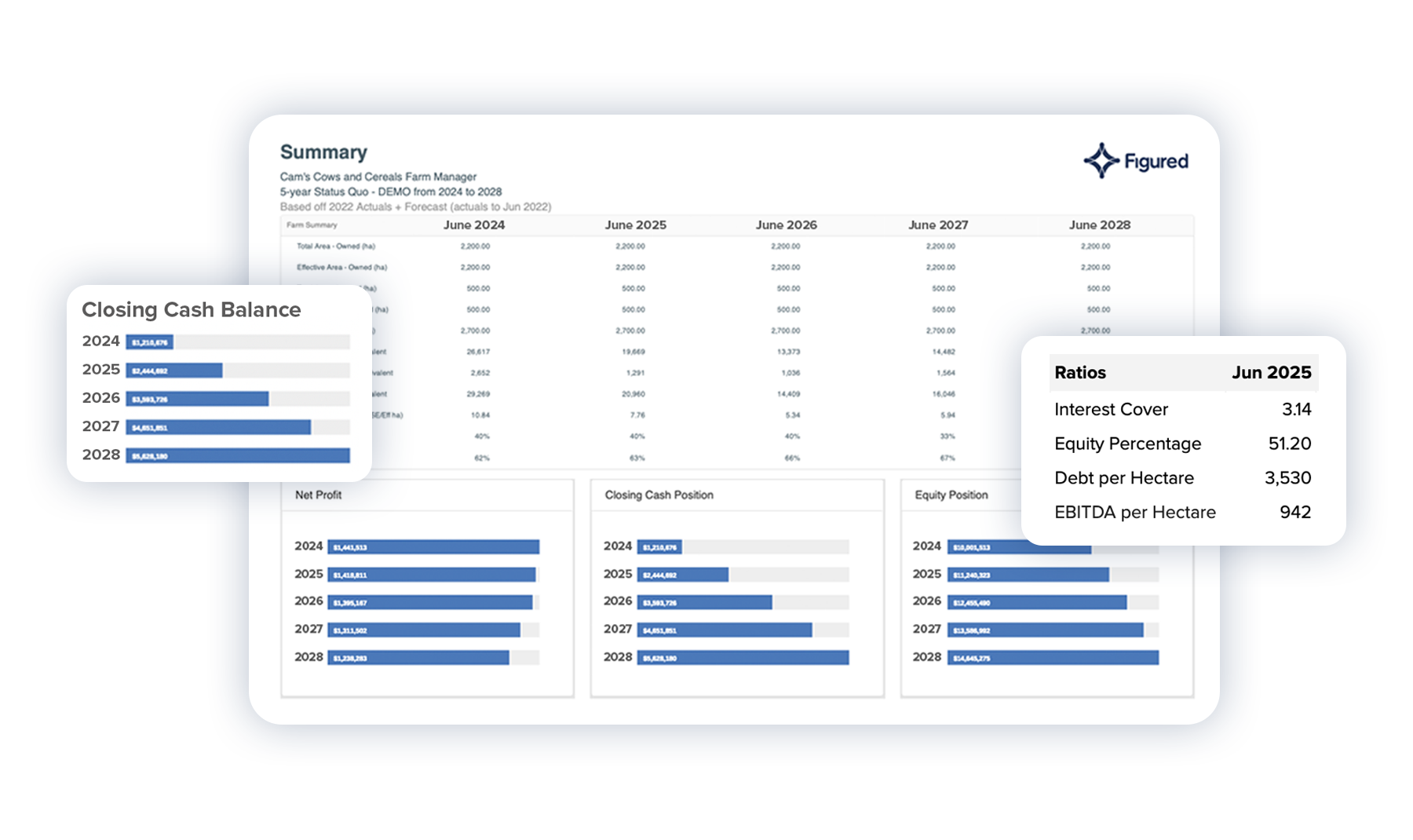

Agri-specific reporting integrated with advanced planning tools so you can build your data asset and lay the foundation to scale high-value services across your portfolio.

- Accessible scenario planning for all your agri clients. Easily model the impact of external factors like El Niño so you and they have a clear view of what it means for them. Give them the ability to look years into the future as well as the current season.

- Easily understand and report on farm performance across key ratios and KPI’s.

- Prepare and report on Statement of Financial Position to provide guidance on equity and optionality.

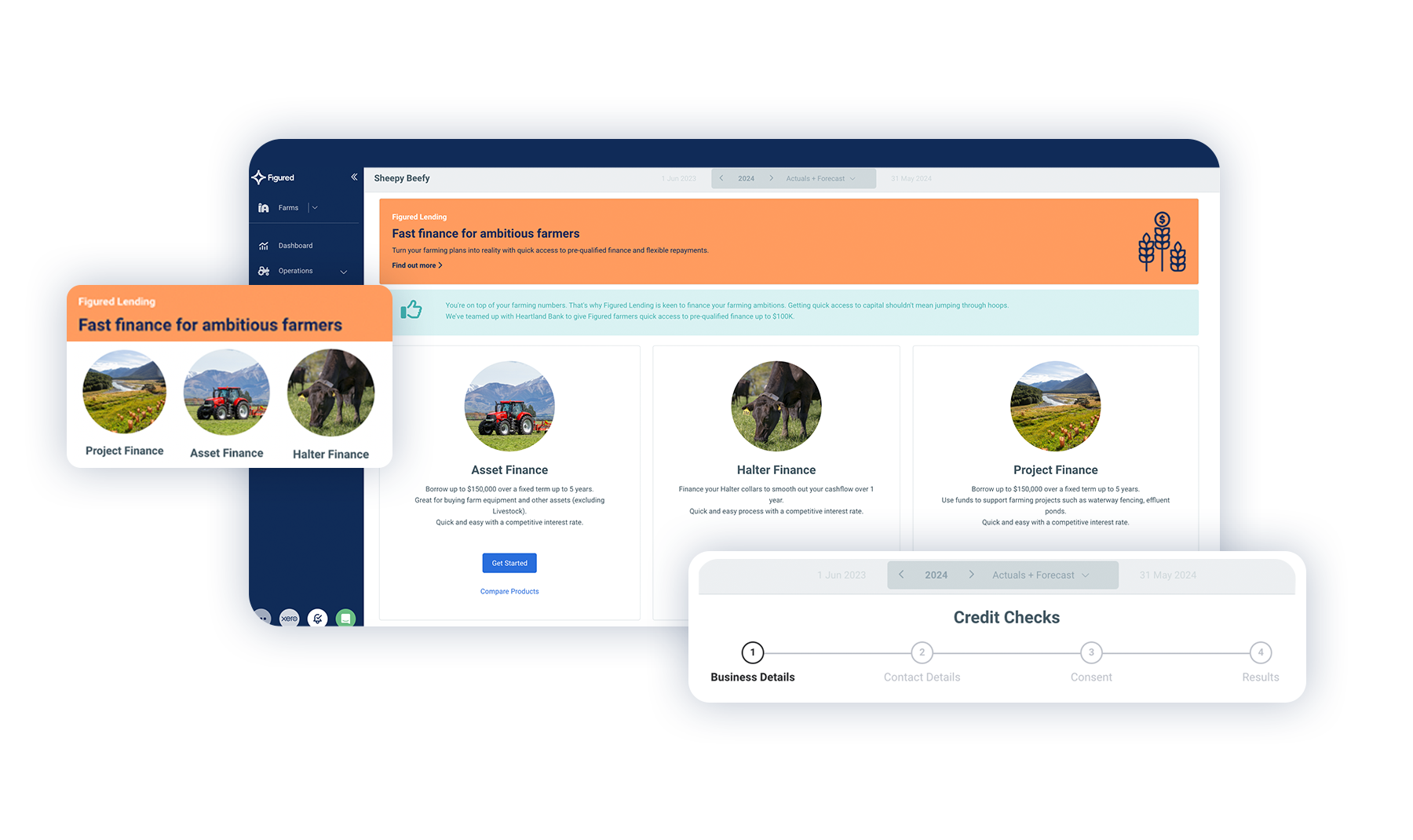

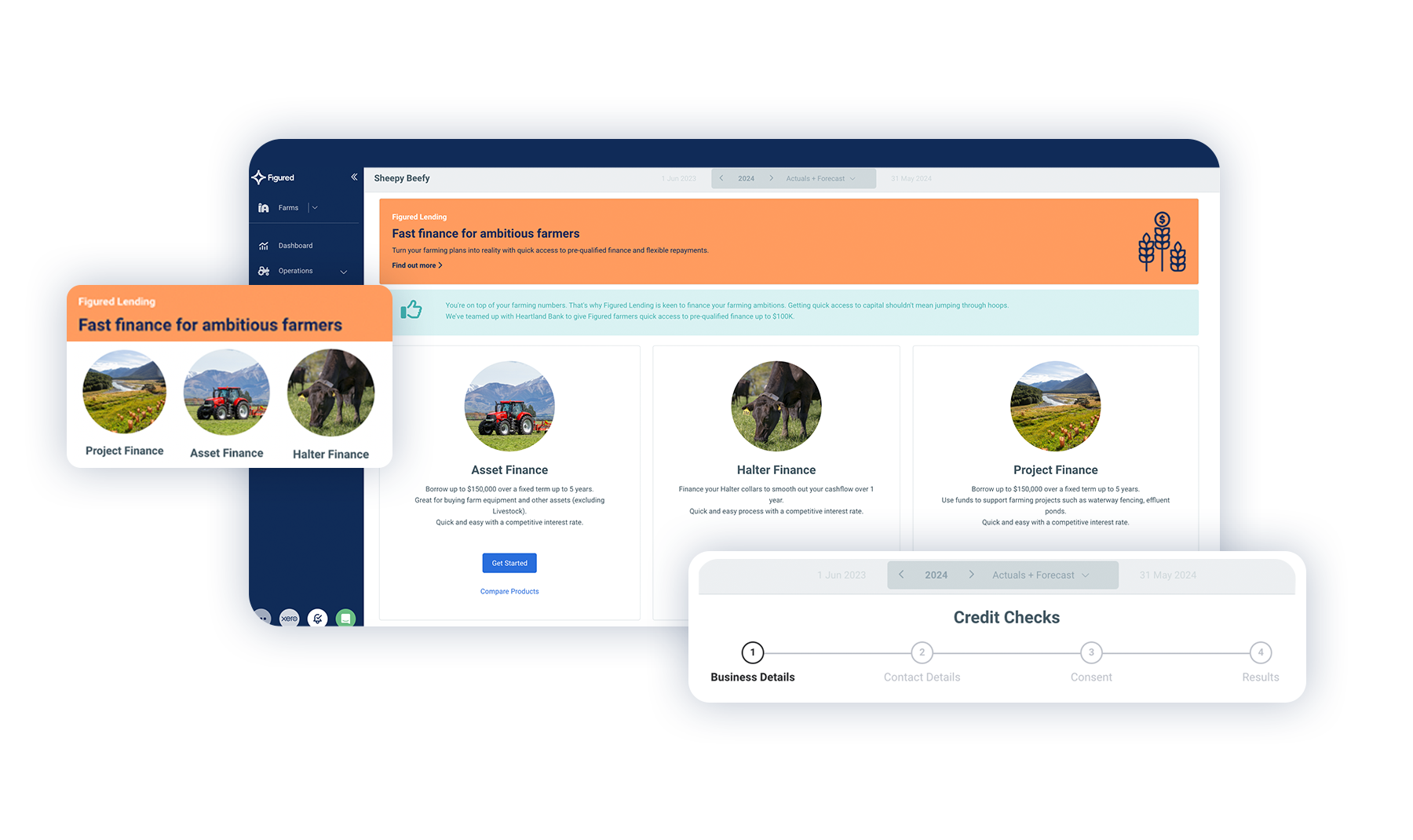

Figured Lending

Figured Lending

An embedded lending solution, empowering you to support your clients with options to leverage the strength of their cash flow position to drive their business forward.

- Project Financing for for sustainability, environmental and other capital projects.

- Halter finance to change the way you pay for Halter.

- Dairy Flexi Credit to cover operational expenses, plant & equipment. purchases, and unexpected expenses.

- Asset financing for new machinery and implements to accelerate on farm improvements.

Figured Insights

The ultimate practice tool for firms to unlock more value-added service opportunities.

- The Figured Advisor’s Dashboard: Monitor your entire client portfolio through a dashboard view to identify clients facing risk or opportunities.

- Model changes in dairy payouts or livestock prices across your portfolio and see which farms are most affected.

- Instantly see interest coverage ratios and identify those who are at risk.

Farm Manager

Powerful three-way forecasting to scale planning services across all your farming clients.

- Create a budget, forecast, and annual plan for your clients with up-to-date financial and production data.

- Monitor variance on an on-going basis, reforecast when needed, and make planning a year-round rather than one-off opportunity with your clients as conditions and on-farm performance changes.

Farm Reporter

Agri-specific reporting integrated with advanced planning tools so you can build your data asset and lay the foundation to scale high-value services across your portfolio.

- Accessible scenario planning for all your agri clients. Easily model the impact of external factors like El Niño so you and they have a clear view of what it means for them. Give them the ability to look years into the future as well as the current season.

- Easily understand and report on farm performance across key ratios and KPI’s.

- Prepare and report on Statement of Financial Position to provide guidance on equity and optionality.

Figured Lending

An embedded lending solution, empowering you to support your clients with options to leverage the strength of their cash flow position to drive their business forward.

- Project Financing for for sustainability, environmental and other capital projects.

- Halter finance to change the way you pay for Halter.

- Dairy Flexi Credit to cover operational expenses, plant & equipment. purchases, and unexpected expenses.

- Asset financing for new machinery and implements to accelerate on farm improvements.

Identify risk & opportunity with the Figured’s Advisor’s dashboard

Figured Insights Advisor's Dashboard will immediately identify an actionable conversation for you to have with your clients to make each engagement more valuable.

Use the Figured Advisors Dashboard during seasonal and one-off events such as:

Farmgate dairy price & red meat schedule adjustment

Significant weather event e.g. El Niño

Interest rate adjustment

Adjustments in farm working costs

EOY reporting/annual review

Promoting higher value services to clients

1) In-season Event Occurs

As and when an event happens in the market, step into your Figured Advisors dashboard to view the live model showing the forecasted impact on your clients.

2) View Dashboard to assess risk & opportunity across all clients

Immediately identify where all of your clients sit on the risk and opportunity quadrants and determine which farms require immediate attention.

3) Investigate alternative models if required

Click to the modelling page to assess & adjust assumptions based on what you know is true and start taking action.

4) Client Engagement

Engage with your clients with a targeted and focused conversation:

- For those at risk: front foot a discussion to proactively plan towards a better outcome, make adjustments, and get bank-ready if needed. If cash flow support is needed, determine if Figured Lending is a suitable option.

- For those presented with an opportunity: present some options for immediate actions and long term opportunities.

5) Scenario Plan Options

Quickly use Figured’s Scenario Planner tool to model each viable option to show the upside and cost of each possible decision.

6) Make a Plan

Get clients to acknowledge the situation and agree to make a plan.

- For clients on Farm Manager: build a plan in the planning grid

- For clients on Farm reporter: build a scenario plan

7) Schedule Ongoing Reviews

Start with bi-monthly reviews, then transition to quarterly or bi-annually once clients are focused on the right KPIs and are confident to independently progress with their plan.

For clients on Farm Manager: create a report pack with a variance and cash flow report. Assess the plan and decide if adjustments are needed.

For clients on Farm Reporter: review the initial scenario plan and assess the farm’s current position and if the farm is tracking to plan or if a new scenario plan is needed.

- Help clients build more resilient & agile businesses.

- Demonstrate and prove the value in ongoing planning and staying on top of your numbers.

Extend your use of the Figured Platform

And start scaling your agri services today

Figured Lending

Front foot conversations around your clients' lending needs throughout the year.

What Figured partners say

“Figured allows us to step into the advisory role because we get the compliance stuff done so efficiently - it's magic.”

"Forward planning and regular reporting made possible with Figured provide better transparency – and banks are incredibly happy with that. It’s a big win and certainly improved our relationship with the client and the bank."

“The traditional approach of preparing an annual budget and locking it away is irrelevant now. With technology like Figured, we are able to update forecasts daily if required."