- Brett Wooffindin, Lawson Avery

Figured Platinum Partner

Volatility in commodity prices, interest rates, supply costs and weather have come one on top of another.

Most firms are responding to the increase in demand for their planning services by using the skills that have served them so incredibly well for so long: their amazing expertise and experience. And combining those skills with the familiar tools of Xero combined with tailored, specialised spreadsheets.

Scaling planning services to more of your agri clients: the 60%+ in the middle majority is stretching your time and staff beyond what's sustainable.

By using the capabilities of technology to reframe planning. It is now possible to deliver high-quality personalised planning services across your portfolio without needing more people or more time.

83%

of NZ farmers who receive these essential high-value services consider their accountant to be “really valuable” (only 23% do so when their engagement is solely compliance!).

By reframing planning as an always-on service, you help your clients achieve better outcomes by instilling best-practice financial management in them. In doing so, you create more opportunities to unlock high-value services for your firm.

Jun-Aug

EOY Reporting:

Building your foundation for value added services

Monthly or Quarterly

Ongoing Reviews:

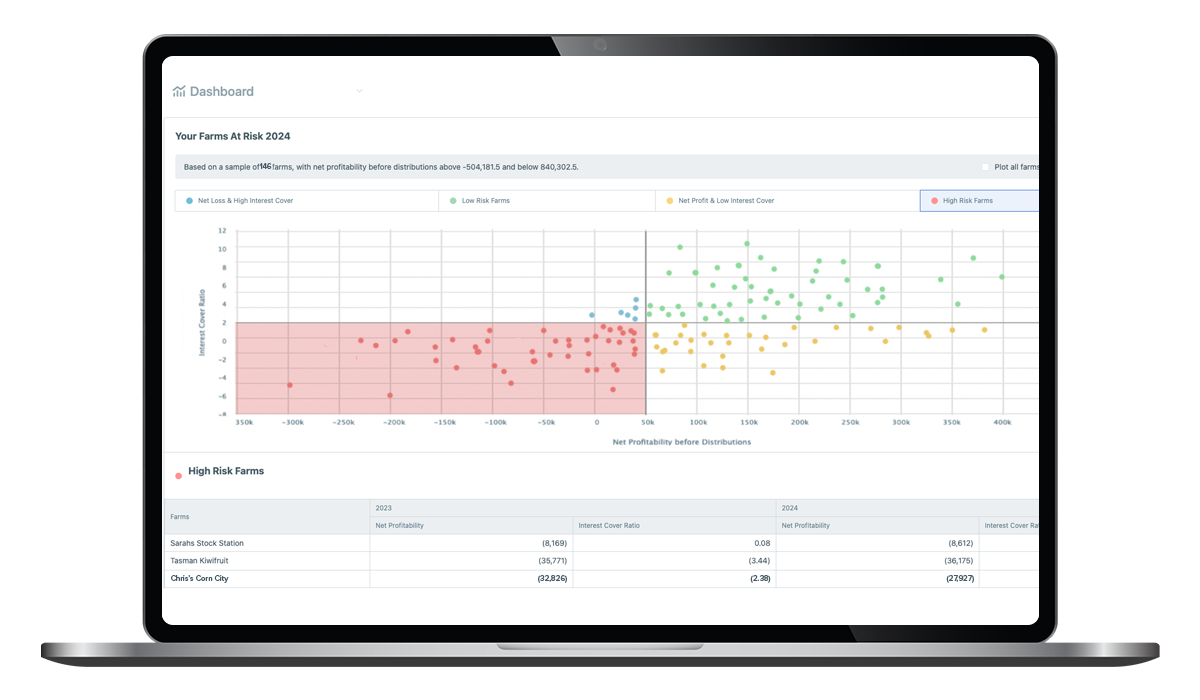

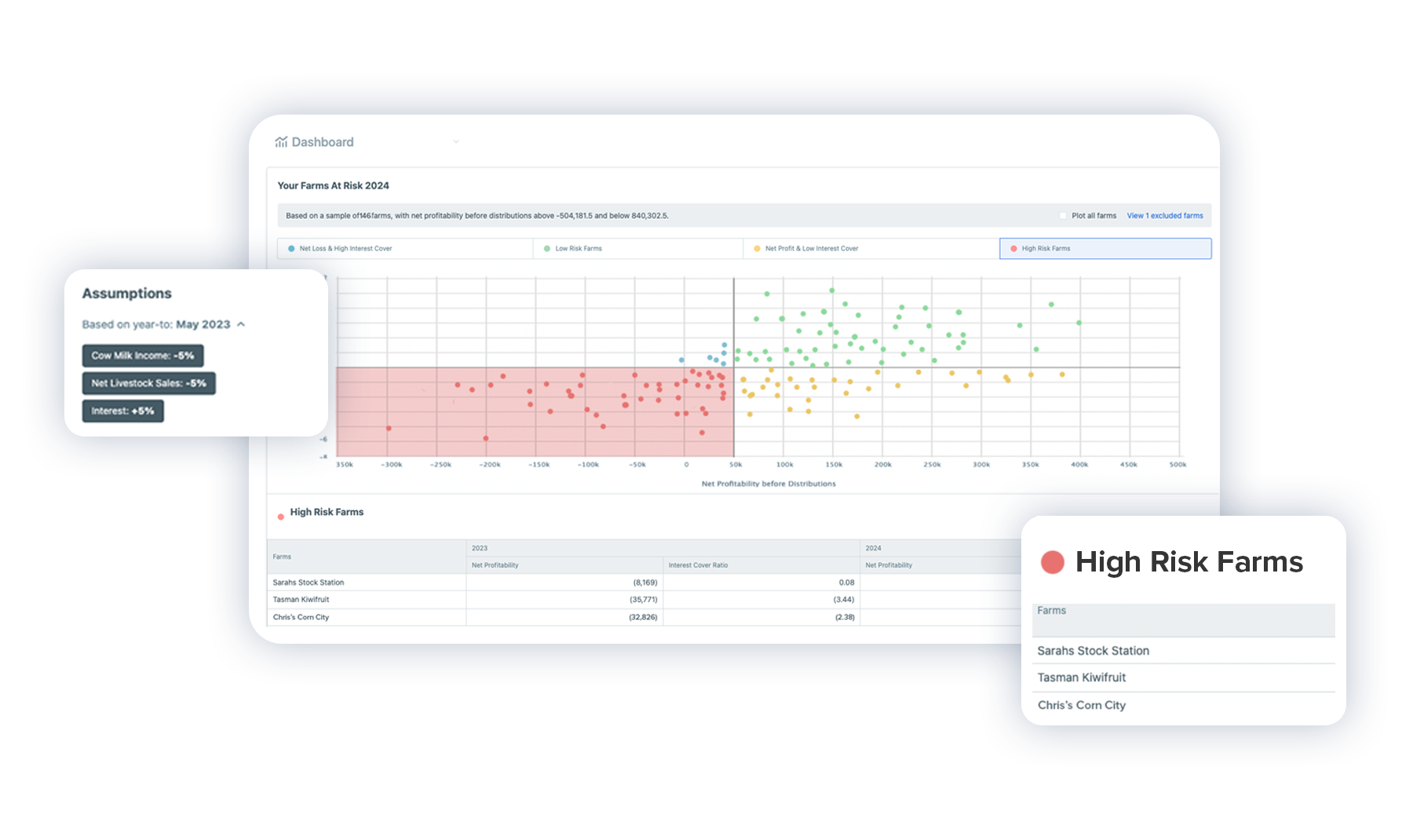

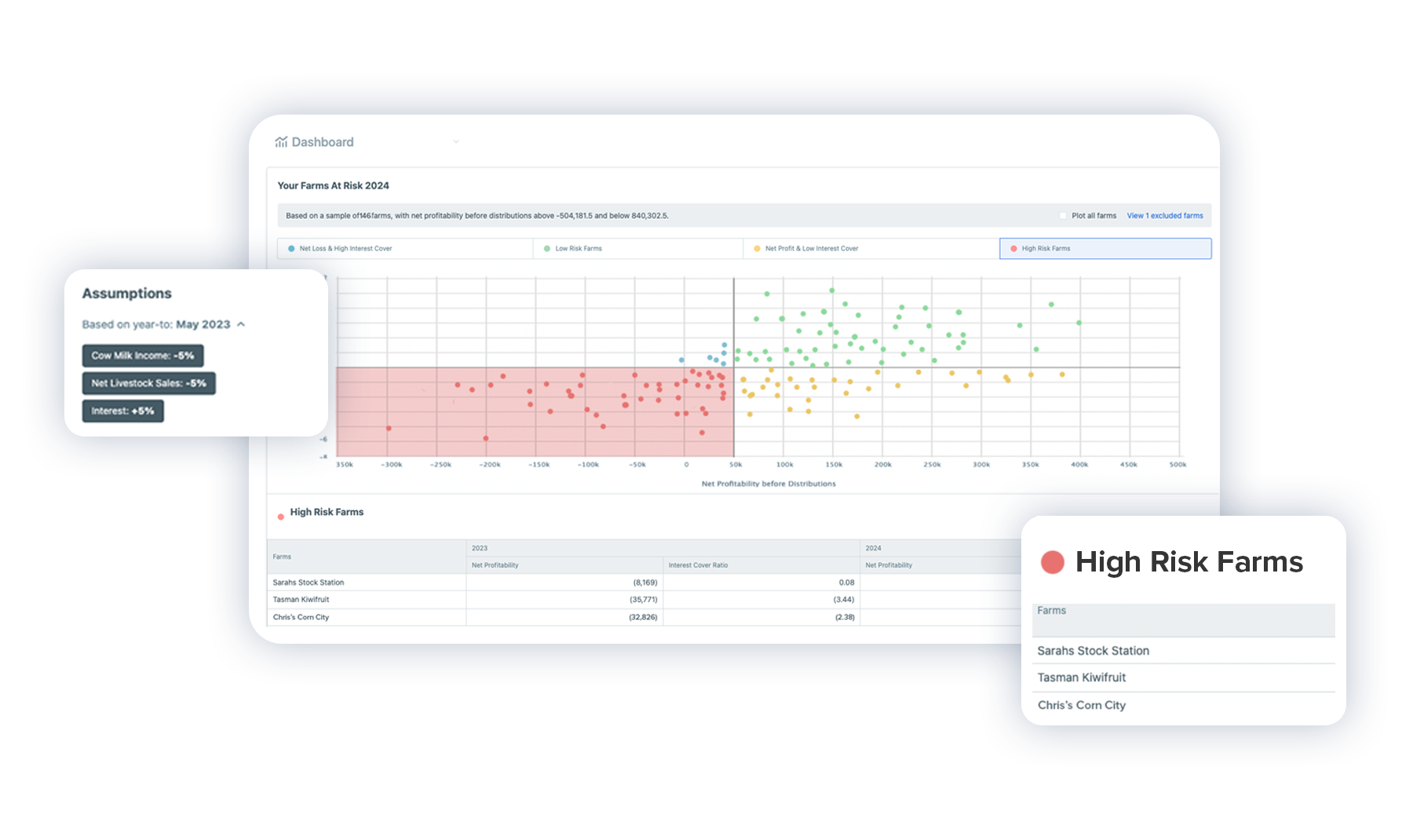

Monitor your clients with the advisory dashboard

In-season events

Price changes / Severe Weather Events:

Update forecasts and plan for change.

Aug

Annual Planning:

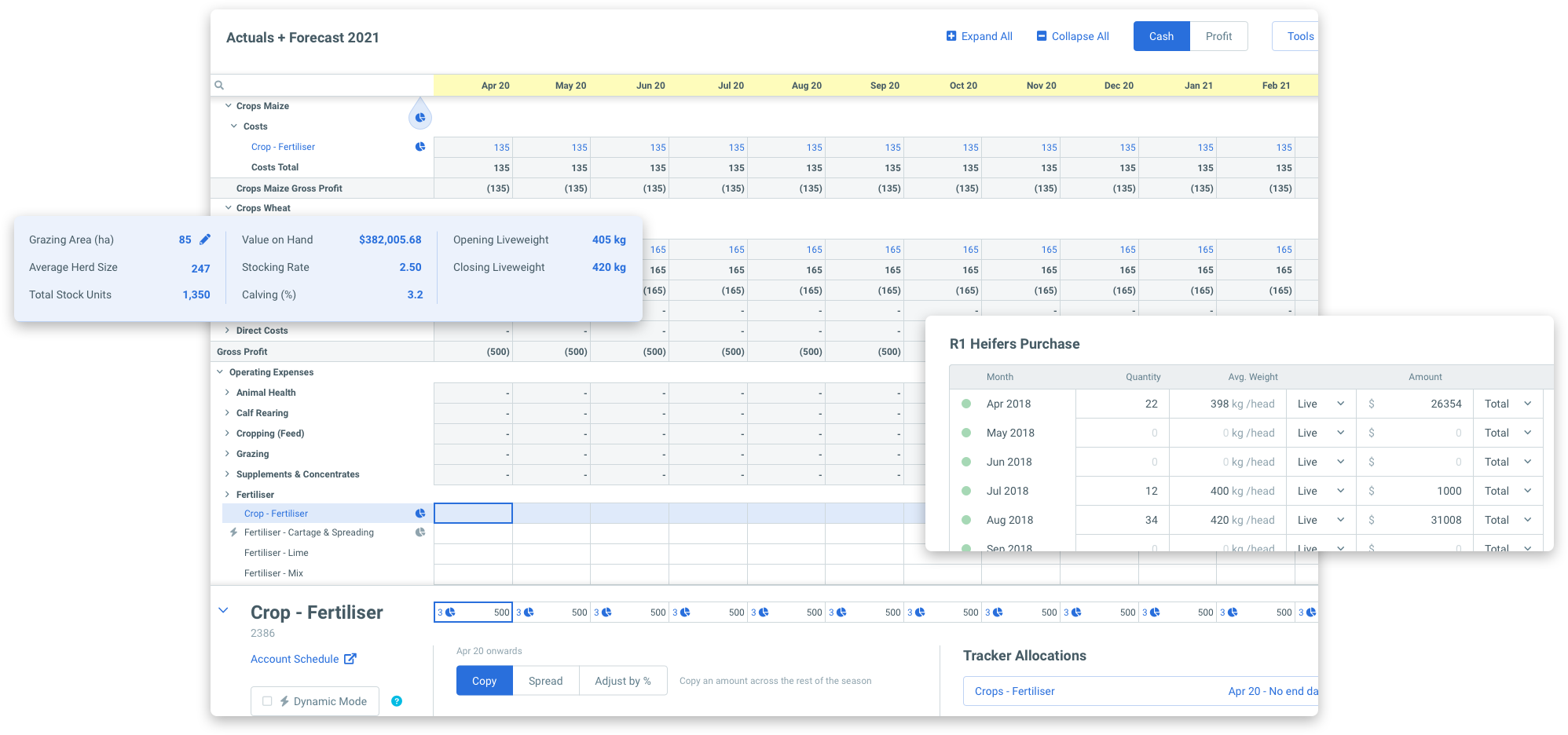

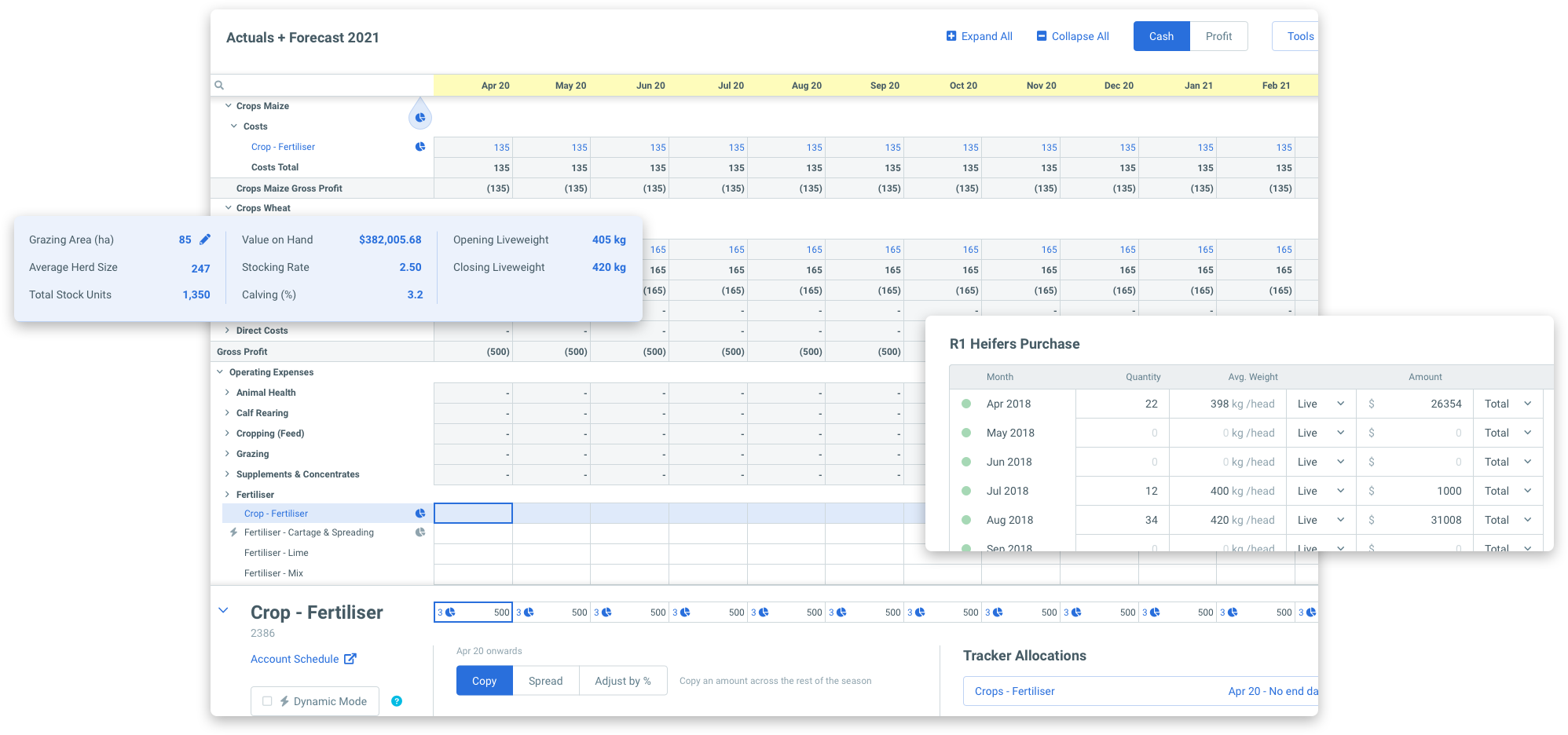

Integrated three-way forecasting

Ongoing

Dynamic Benchmark Reporting:

In-season benchmarking for compliance and planning clients

Jun-Aug

EOY Reporting

Aug

Annual Planning

Monthly or Quarterly

Ongoing Reviews

Ongoing

Dynamic Benchmark Reporting

In-season Events

Commodity price, interest costs, weather changes & more

Start using the full extent of the Figured Platform to scale your agri planning services.

Diver deeper into Figured

And learn how to start scaling your agri services today

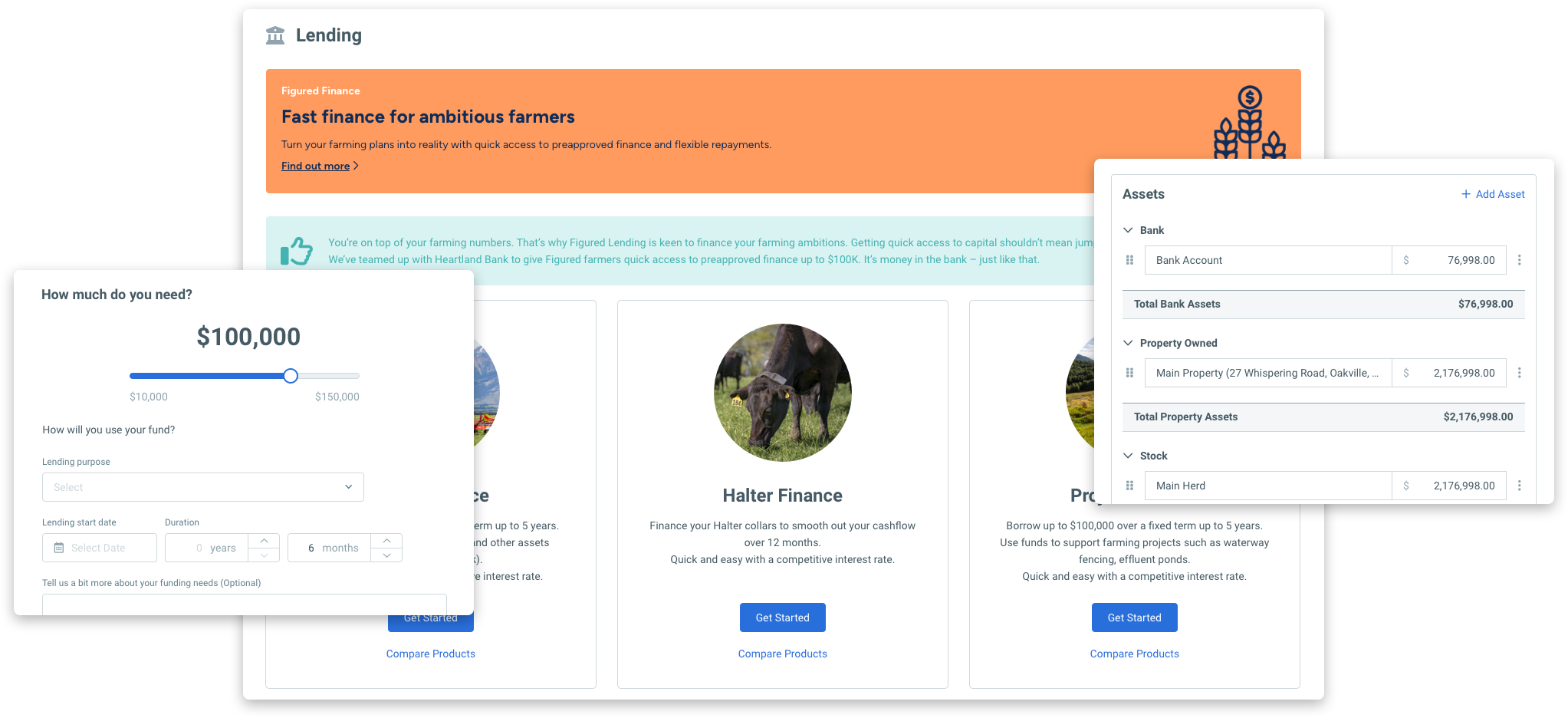

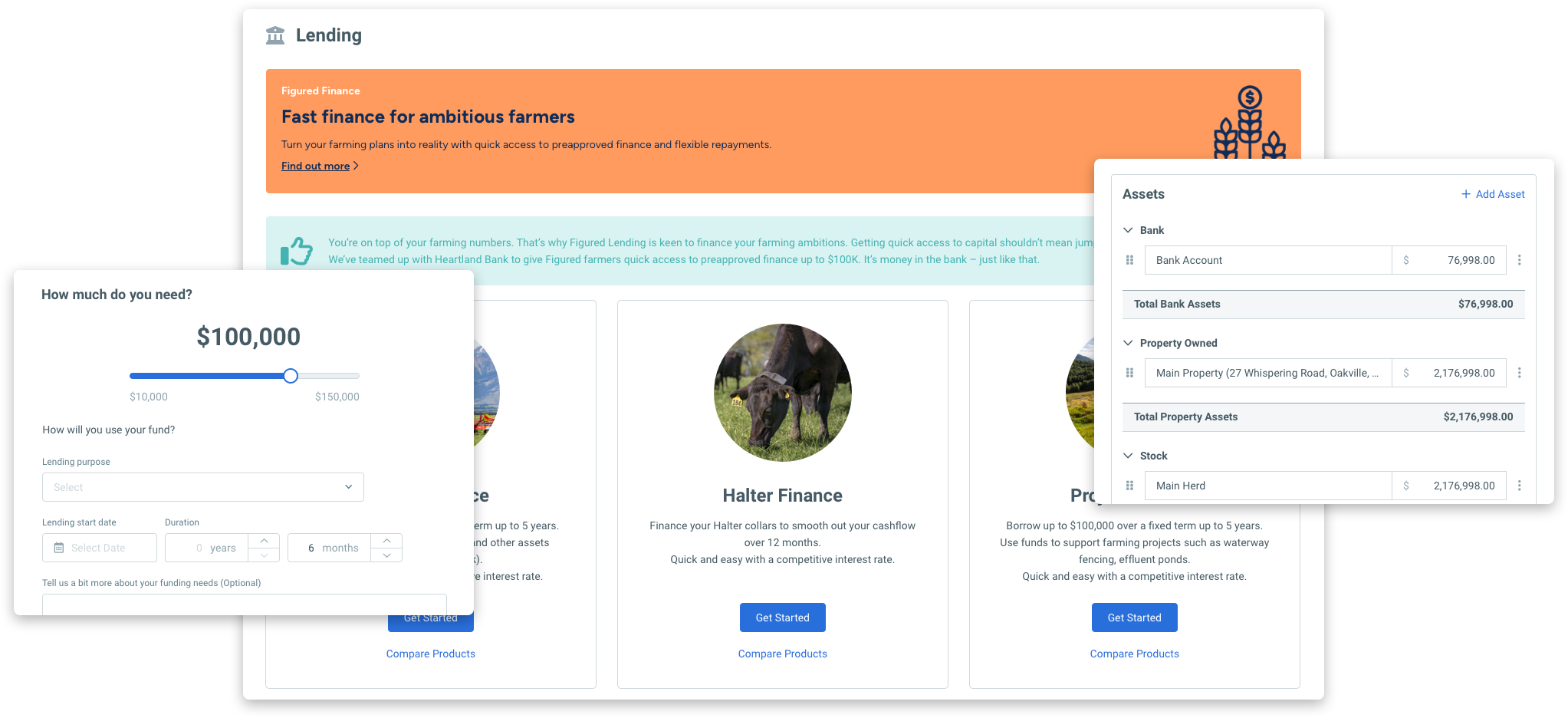

Front foot conversations around your clients' lending needs throughout the year.

Establish a more comprehensive role for how you and your firm provides finance & cashflow solutions to your clients. With Figured Lending embedded directly in Figured, it provides the immediate access and transparency that you need to become the expert in advising clients on their lending opportunities, eligibility, execution and ongoing risk management.

“Figured allows us to step into the advisory role because we get the compliance stuff done so efficiently - it's magic.”

"Forward planning and regular reporting made possible with Figured provide better transparency – and banks are incredibly happy with that. It’s a big win and certainly improved our relationship with the client and the bank."

“The traditional approach of preparing an annual budget and locking it away is irrelevant now. With technology like Figured, we are able to update forecasts daily if required."

The ultimate practice tool for firms to unlock more value-added service opportunities.

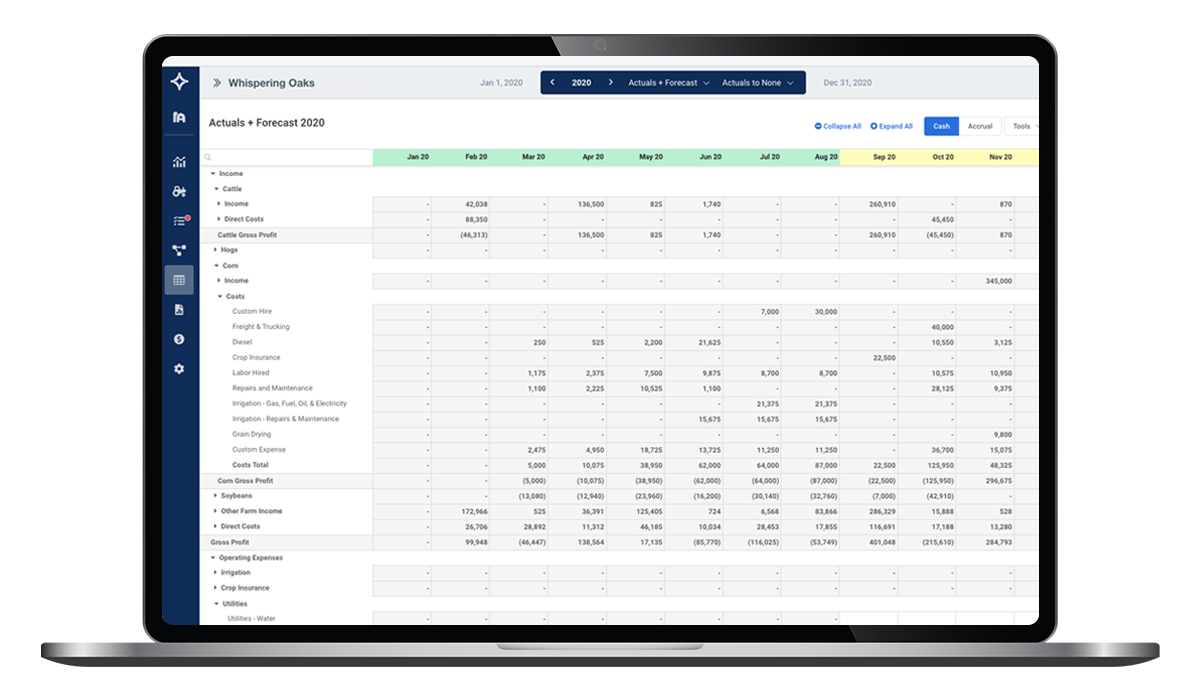

Powerful three-way forecasting to scale planning services across all your farming clients.

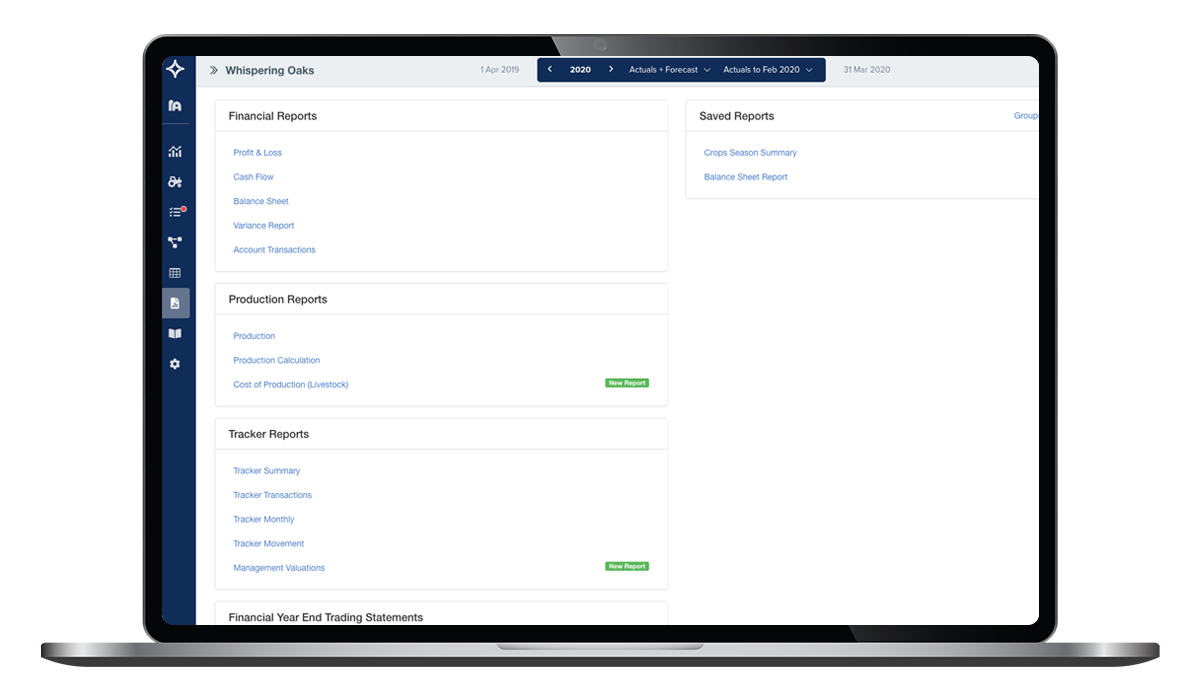

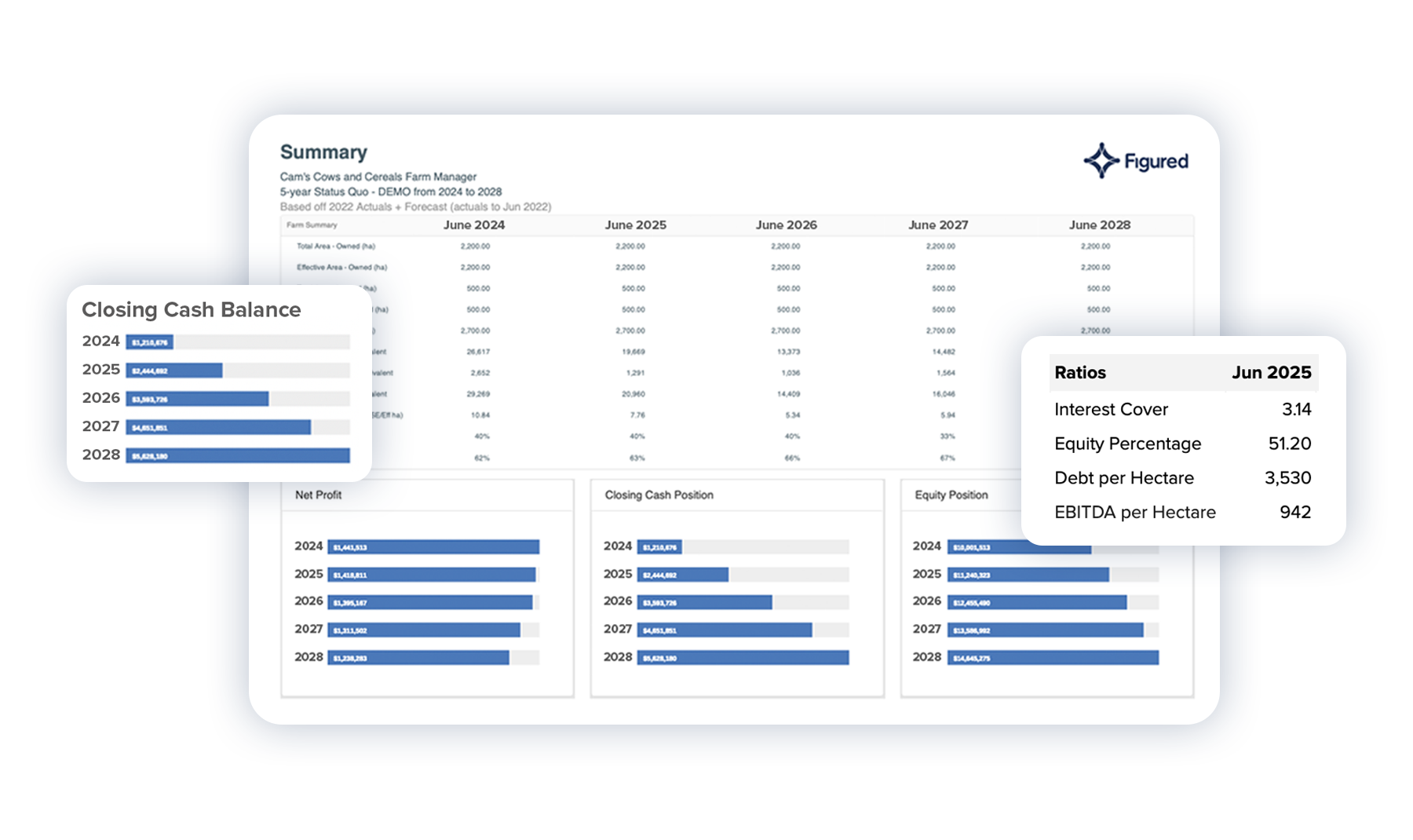

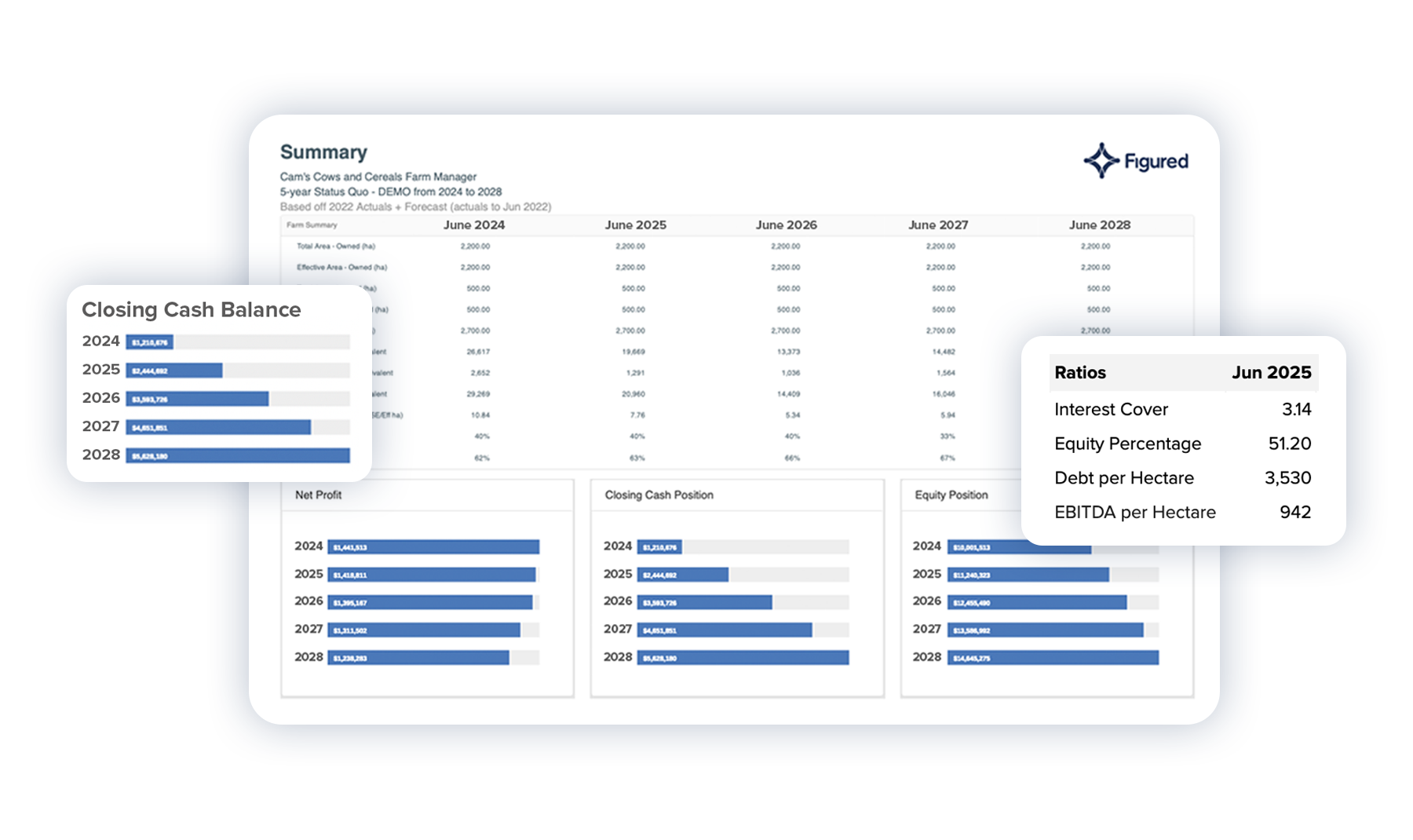

Agri-specific EOY reporting integrated with advanced planning tools so you can build your data asset and lay the foundation to scale high-value services across your portfolio.

An embedded lending solution, empowering you to provide better advice and service to support your clients through their lending journey.

The ultimate practice tool for firms to unlock more value-added service opportunities.

Powerful three-way forecasting to scale planning services across all your farming clients.

Agri-specific EOY reporting integrated with advanced planning tools so you can build your data asset and lay the foundation to scale high-value services across your portfolio.

An embedded lending solution, empowering you to provide better advice and service to support your clients through their lending journey.