ON DEMAND WEBINAR

Real-Time Livestock Advisory: The Framework Top Advisers Use

See the 3-part framework that allows accountants and agri advisers to respond to livestock decisions in hours instead of weeks—transforming annual compliance relationships into year-round strategic partnerships.

Featuring special guest speaker:

Tony Olsen, Director at Flor Hanly

![]()

Watch Now:

Here's what's keeping you out of those conversations:

- "By the time I can pull together the financial analysis, my client has already made the decision." The stocking rate purchase was last Saturday. The breeding stock buy happened Tuesday. You found out after.

- "My cattle clients need answers in days, not weeks." When beef prices swing or a buying opportunity appears, they can't wait for you to chase data, update spreadsheets, and build scenarios from scratch.

- "I want to provide strategic advice, but livestock operations move too fast." Markets shift. Weather changes. Decisions need to be made in 2 hours, not 2 weeks—and your current process can't keep up.

The truth: Your livestock clients aren't too unpredictable to advise. Your response time is too slow. And it's costing both of you more than you realise.

Watch Now:

What You'll Learn

This isn't theory. You'll see the actual 3-part framework that leading Australian advisers use to respond to livestock decisions in 24-48 hours instead of weeks—turning annual compliance relationships into year-round strategic partnerships.

The Real Problem

- Why 87% of farmers plan alone—and why it's not about unpredictability.

- The exact bottleneck keeping you out of high-value livestock advisory opportunities—and limiting your revenue potential.

- Why "decisions in hours, not weeks" is the dividing line between advisory partners and compliance vendors.

The 3-Part Framework

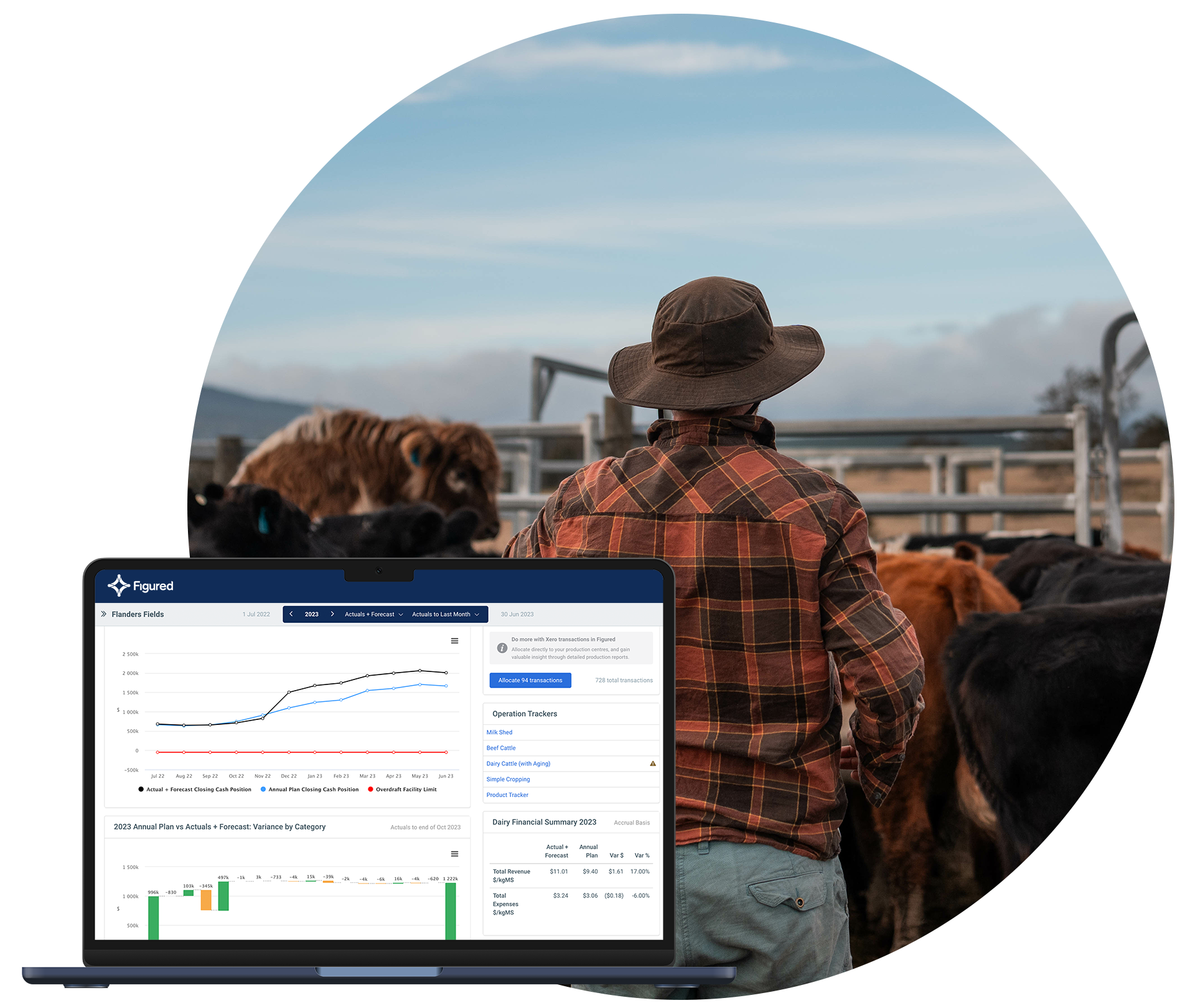

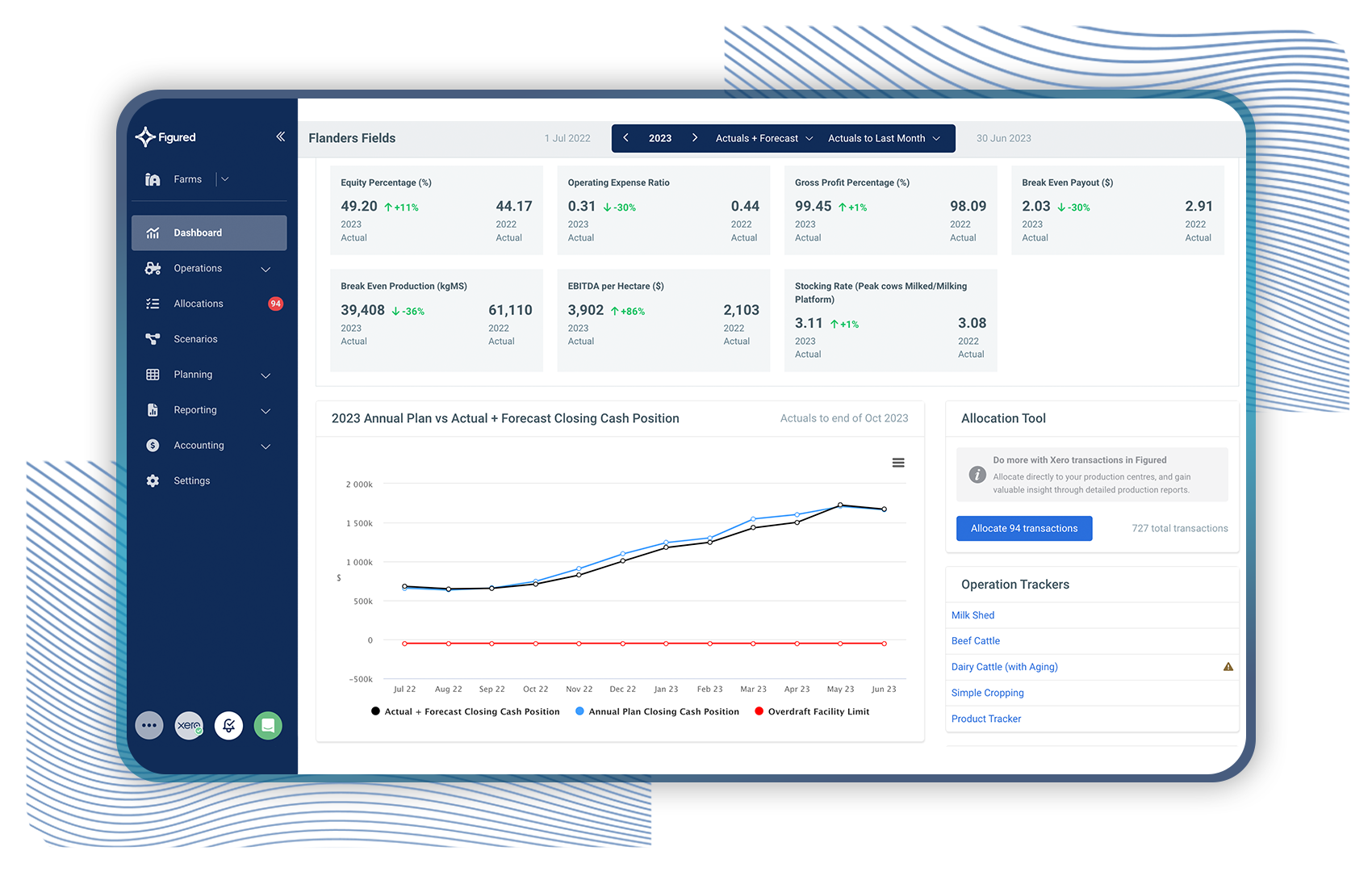

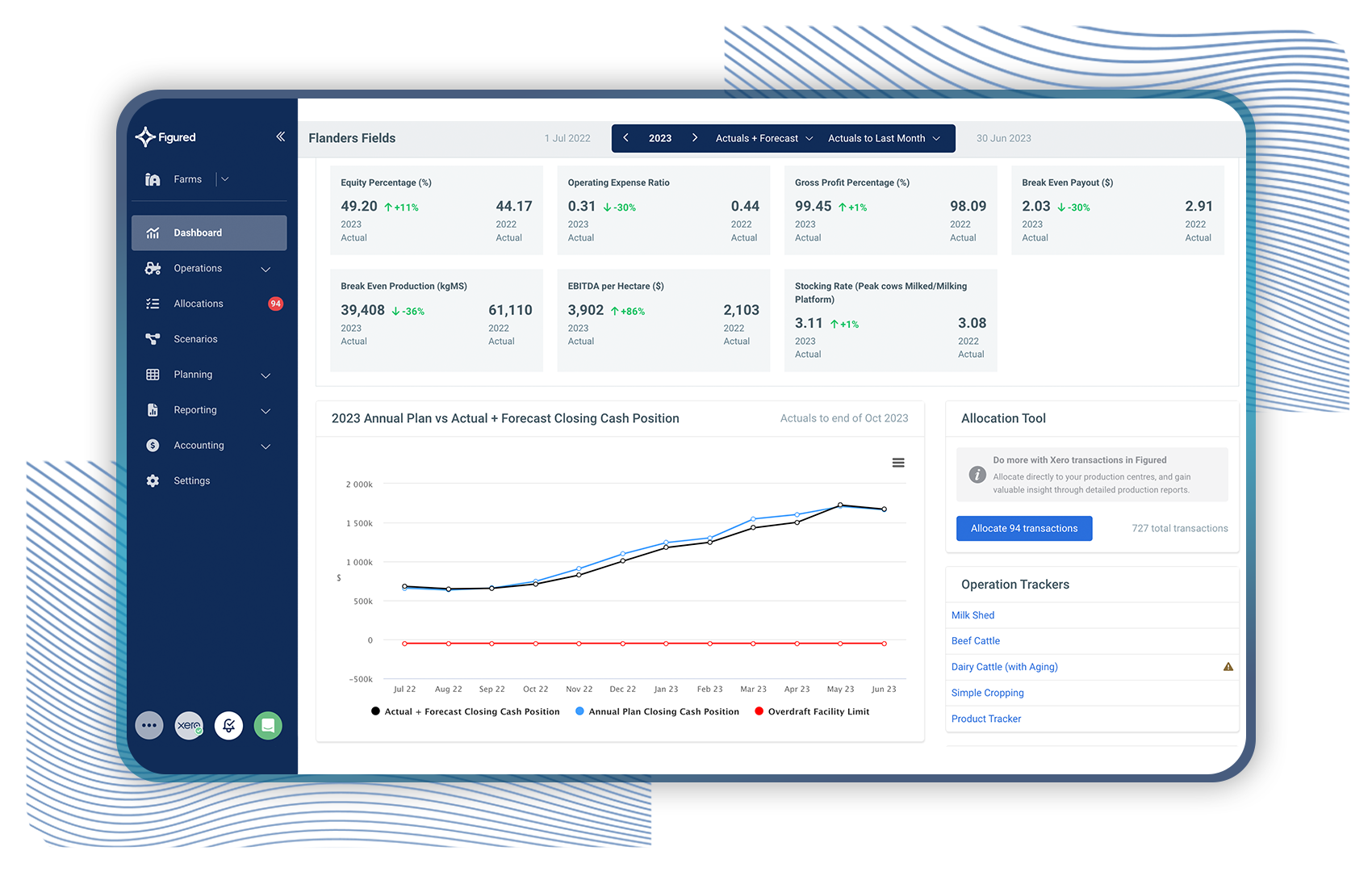

- Part 1: Continuous Visibility — How to move from annual financial statements to real-time position, so when your client calls Friday about a Saturday auction, you can answer in the call

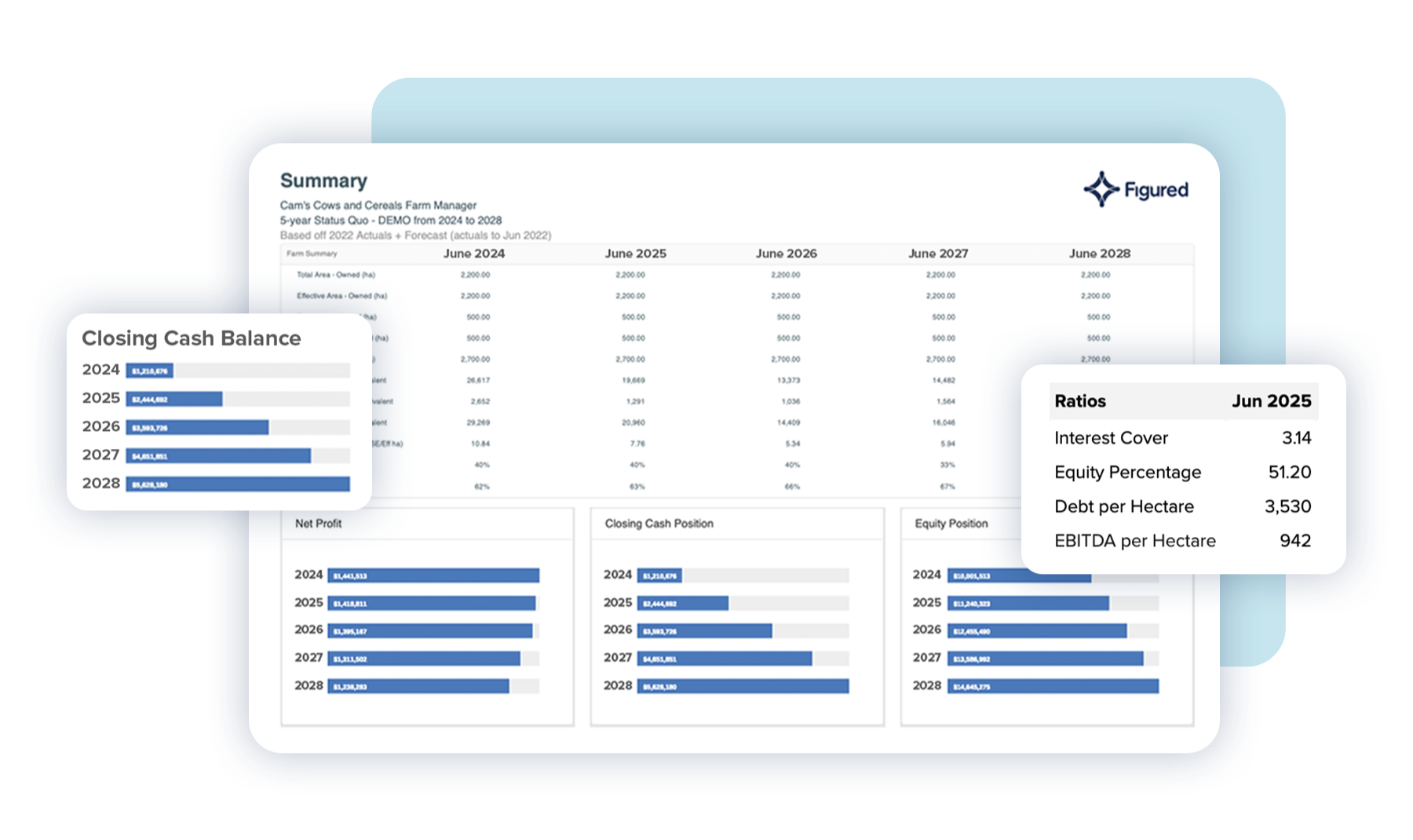

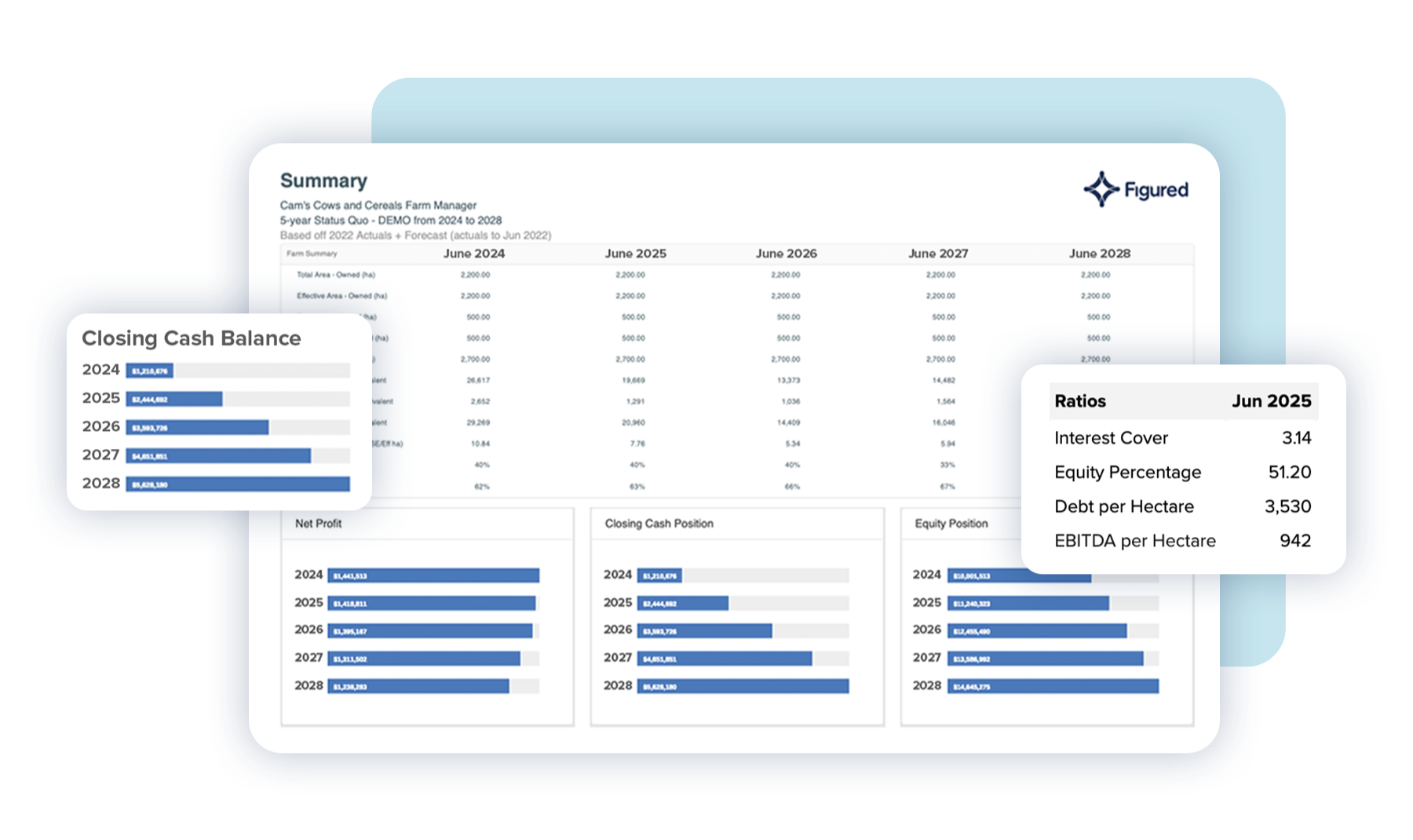

- Part 2: Forward Planning — How to model best/worst/likely cases in hours not weeks, so your client has decision-ready analysis Thursday morning instead of "let me get back to you in a couple of weeks"

- Part 3: Proactive Touchpoints — How to structure quarterly strategic reviews that position you as the adviser they call before decisions, not after

What This Enables

- Revenue uplift of 197% to 327% when firms move from compliance to advisory positioning.

- Stickier client relationships built on year-round value, not just annual tax returns.

- A repeatable framework that works across all livestock clients—beef, sheep, mixed operations.

.png)

Featuring one of Australia's

leading Livestock advisers

Tony Olsen, Director, Flor Hanly

Tony brings nearly 30 years of experience serving primary producers as Director at Flor-Hanly, a specialist agribusiness accounting firm servicing Mackay and Central Queensland. Beyond traditional tax accounting, the firm focuses on strategic planning and cash flow management—helping agricultural clients navigate today's complex farming environment.

Operating the Lindley Park Brahman Stud on his own properties near Mackay, Tony understands livestock operations from both sides of the desk—as adviser and operator. This dual perspective gives him unique insight into the real challenges livestock producers face.

His passion for helping producers see the "big picture" and plan strategically makes him an ideal contributor to this framework workshop.

A scalable planning framework for any client

The top-performing livestock advisers aren't working harder—they've changed how they work. Here's the three-part framework you'll learn:

Continuous Visibility

Continuous Visibility

Instead of: Annual financial statements that are out of date the moment they're printed.

You create: Real-time connection between livestock movements and financial position.

This means: When your client calls about a buying opportunity, you can see their current cash position, equity, and debt immediately—no more "let me pull that data and get back to you."

What it enables: Answer questions in the call, not days later. Catch cash flow issues before they become crises. Position yourself as the adviser who always knows the current state.

Fast Scenario Planning

Fast Scenario Planning

Instead of: Building forecasts from scratch every time a decision needs to be made (taking a couple of weeks).

You create: Framework for running best/worst/likely scenarios in hours, not weeks.

This means: Client calls Tuesday about Saturday auction. Thursday morning they have three scenarios showing exactly what happens at different price points and purchase sizes.

What it enables: Be in the room when decisions are made, not finding out after. Model "what if" questions while the window is still open. Strategic partner, not compliance vendor.

Proactive Touchpoints

Proactive Touchpoints

Instead of: Annual meetings focused on historical compliance.

You create: Quarterly strategic reviews using current data, focused on forward decisions.

This means: You're discussing next quarter's opportunities and challenges before they happen, not documenting last year's results.

What it enables: Shift from reactive to proactive advisory. Justify premium fees based on ongoing strategic value. Build stickier relationships that don't churn.

Continuous Visibility

Instead of: Annual financial statements that are out of date the moment they're printed.

You create: Real-time connection between livestock movements and financial position.

This means: When your client calls about a buying opportunity, you can see their current cash position, equity, and debt immediately—no more "let me pull that data and get back to you."

What it enables: Answer questions in the call, not days later. Catch cash flow issues before they become crises. Position yourself as the adviser who always knows the current state.

Fast Scenario Planning

Instead of: Building forecasts from scratch every time a decision needs to be made (taking a couple of weeks).

You create: Framework for running best/worst/likely scenarios in hours, not weeks.

This means: Client calls Tuesday about Saturday auction. Thursday morning they have three scenarios showing exactly what happens at different price points and purchase sizes.

What it enables: Be in the room when decisions are made, not finding out after. Model "what if" questions while the window is still open. Strategic partner, not compliance vendor.

Proactive Touchpoints

Instead of: Annual meetings focused on historical compliance.

You create: Quarterly strategic reviews using current data, focused on forward decisions.

This means: You're discussing next quarter's opportunities and challenges before they happen, not documenting last year's results.

What it enables: Shift from reactive to proactive advisory. Justify premium fees based on ongoing strategic value. Build stickier relationships that don't churn.

This Webinar Is Deigned For:

- Agricultural accountants and advisers serving beef cattle, sheep, or mixed farming operations—even if livestock isn't your primary focus.

- Practices ready to move beyond annual compliance and establish recurring advisory revenue from livestock clients who currently only engage once a year.

- Advisers who want to be in the strategic conversations when clients make six-figure capital decisions—not finding out about them months later during tax season.

- Firms that have tried to provide livestock planning before but found the manual data gathering and spreadsheet building took too long to be commercially viable.

You'll Get The Most Value If You:

- Currently serve multiple livestock operations (or have clients asking about adding livestock enterprises but you've been hesitant due to the perceived complexity).

- Use Xero, QuickBooks, or MYOB for your agricultural clients and are looking for specialised livestock financial management capabilities.

- Want to see a practical framework that makes responding in to changing conditions in hours actually possible.

- Are open to changing how you deliver advisory services rather than just adding more tools to your current process.

ON DEMAND WEBINAR

45 minutes that could transform how you serve livestock clients. See the 3-part framework that's enabling advisers to respond to critical client requests in hours instead of weeks, positioning them as strategic partners rather than compliance vendors.