Protect Your Milk Income

Plan with Confidence

Lock in a minimum milk price and protect your farm’s future from market volatility.

Understand how price shifts affect your farm's breakevens directly within Figured.

Protect your income from market drops while still benefiting from rising prices.

Improve cash flow certainty to support financial planning, on-farm decisions, and debt repayments.

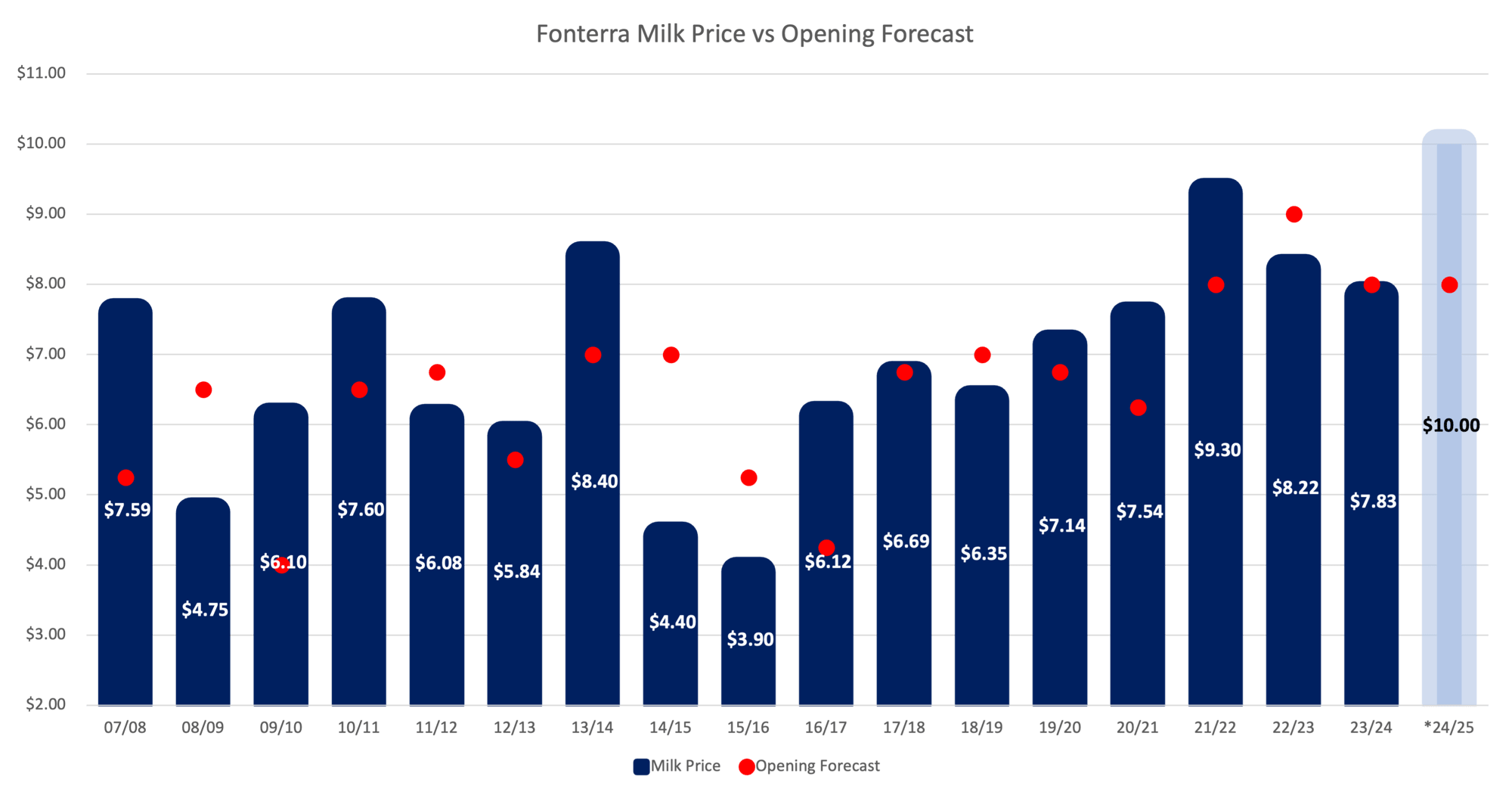

The Reality of a Volatile Market

Milk prices rise and fall, but your farm’s financial stability doesn’t have to

Protect your breakeven and confidently plan for the future

Why Choose Milk Price Protection?

A Practical Solution to Protect Your Farm’s Milk Income

Simple and Accessible

Designed specifically for dairy farmers, not financial traders. This solution helps you understand your risk and gives you the tools to protect your milk income in a clear, uncomplicated way.

Clear & Transparent

With likeness to insurance, you’ll pay a clear, one-off premium with no surprises. Lending options are also available to cover the premium to help manage your cash flow.

Flexible Protection

Protect as much or as little of your milk income as you like. If market prices rise, you can take advantage of the gains, while still having peace of mind that your minimum price is secured.

THE FIGURED ADVANTAGE

- Direct connection to the farm’s personal financial plans – Milk Price Protection is fully integrated into Figured, allowing for better decision-making in the context of a farm’s broader financial strategy.

- Scenario planning & ‘What-if’ analysis – Model the impact of Milk Price Protection on break-evens directly in Figured. Understand how different price levels affect cash flow, profitability, and financial resilience.

- Simple access, up to three seasons in advance – Farmers can seamlessly access Milk Price Protection within Figured.

- Expert guidance through a nationwide network of financial advisors – Farmers don’t have to navigate this alone. Figured provides structured support through a trusted network of advisors who understand farm financial planning.

- Lending options to spread the cash requirements – Lending solutions are available to help cover the upfront cost of securing a minimum milk price, ensuring farms can protect their income without impacting immediate cash flow.

WANT TO LEARN MORE?

Backed by Industry Experts

Powered by StoneX, a global leader in agricultural risk management, providing reliable support and expertise to help you protect your income with confidence.

How it Works

![]() Use the Calculator: Log in to Figured and calculate what Milk Price Protection could look like for your farm, including estimated premiums.

Use the Calculator: Log in to Figured and calculate what Milk Price Protection could look like for your farm, including estimated premiums.

![]() Speak with Your Advisor: Discuss your strategy and confirm the milk solids you'd like to protect.

Speak with Your Advisor: Discuss your strategy and confirm the milk solids you'd like to protect.

![]() Create an Account: Sign up for a StoneX account through Figured and complete the onboarding application to unlock Milk Price Protection.

Create an Account: Sign up for a StoneX account through Figured and complete the onboarding application to unlock Milk Price Protection.

![]() Lock in Your Prices: Secure a minimum price for your milk solids and start protecting your farm’s income.

Lock in Your Prices: Secure a minimum price for your milk solids and start protecting your farm’s income.

Milk Price Calculator

Use our Milk Price Calculator to:

- Explore potential savings and costs.

- Compare market scenarios and price protection benefits.

- Plan your strategy with clarity.

Frequently Asked Questions

What are my options for managing milk price volatility?

Farmers have three common tools to manage price risk: Fixed Price, Futures, and Puts. Here’s how they compare:

- Fixed Price Agreements

How it works: Between March and December, Fonterra allows you to lock in a set price for your milk solids in advance. This price is based on the market at the time of offering, and you can apply to fix a portion of your supply.

Pros: Fixed price agreements are simple and provide certainty. Your income is guaranteed at the agreed price.

Cons: You don’t get to choose the price, it’s set by Fonterra. There’s also a 10-cent service fee per kgMS, and you won’t benefit if market prices rise above the fixed price.

- Futures Contracts

How it works: A futures contract is an agreement to lock in a price for your milk solids at a future date. You pay a deposit upfront (called the initial margin) to secure the contract. If the market price drops below your agreed price, you receive payments to cover the difference. If the market price rises above your agreed price, you’ll need to pay the difference. At the end of the contract, the final payment settles the difference between the market price and your agreed price.

ProsS: Futures allow you to fix your milk price for a given season. The upfront cost may be lower than it would be if put options were used, which means there is less immediate cash outlay.

Cons: Futures fix your milk price for the given season, meaning if the market rises above the level at which you sold futures, you will not benefit from the higher prices. You will also have to deposit margin payments to maintain your position. These payments can cause pressure on cash flow throughout the season.

- Put Options (Milk Price Protection)

How it works: Milk Price Protection simplifies a common financial tool (put options) making them easy to access and use through an integrated solution.

You pay an upfront premium to secure a minimum milk price for your milk solids. If market prices drop below your agreed price, you’re protected and paid the difference. If market prices rise, you keep the flexibility to take advantage of the higher prices without being locked in.

Pros: Put options offer downside protection with upside flexibility. You’re not tied to a fixed price, and there are no unexpected cash payments during the season. While it may cost more upfront, the price is fixed with no unexpected extra costs. The upfront premium may be tax deductible but individual circumstances will vary so we recommend you seek tax advice from your accountant. Payments are made at the end of the season.

Cons: You pay the premium upfront, even if market prices don’t drop.

Which option is best for me?

The best choice depends on your farm’s priorities and how you manage risk. Fixed Price Agreements are ideal for guaranteed income certainty and a simple setup, but you won’t benefit from higher market prices. Futures Contracts work well if you want to choose your price and prefer a lower upfront cost, though they require regular market monitoring and potential extra payments. Put Options are best for flexibility, protecting against price drops while benefiting from higher prices, with clear upfront costs and no unexpected payments.

How much does Milk Price Protection cost?

You’ll pay a one-off premium upfront, based on the amount of milk solids you protect and the price you lock in. The cost depends on:

- Market conditions.

- Your production volume you would like to protect

- The minimum price you choose to secure.

Lending options are also available to help cover the premium if needed.

How do I qualify for this service?

To participate you must be a Wholesale Investor that meets the definition of ‘large’ (the investor has net assets or turnover exceeding $5 million for the last two completed financial years). Your accountant will be able to verify this for you.

How do I benefit if prices go up?

Milk Price Protection gives you the flexibility to take advantage of higher market prices. You’ll still receive your full payout from your Milk Supplier. If the payout is higher than the price you secured, you won’t receive any additional payments from StoneX, but you’ve only paid the premium, similar to insurance. If the payout is lower than your secured price, StoneX will pay you the difference.

When do I get paid if the market drops?

The final farmgate milk price is announced around September, after the season ends. If the final price is lower than your secured price, StoneX will pay you the difference at settlement.

.

Who is StoneX?

StoneX is a global financial services company that specialises in helping farmers and businesses manage risks like price volatility. They have decades of experience working with agricultural markets, including the dairy industry, and provide the tools and expertise needed to protect your income. Figured has partnered with StoneX because they are trusted experts in this space, helping farmers lock in prices with confidence.