Immediately connect to up to date data to make credit decisions with confidence.

Rural managers are an integral part of the farm advisory team, so connecting farmers with their bank gives them the support they need to grow and better manage the volatilities of the industry.

Figured gives rural bank managers the ability to track and view customers’ financial performance in real-time, quickly evaluate risk or opportunities, and deliver decisions back to your customers efficiently and with confidence.

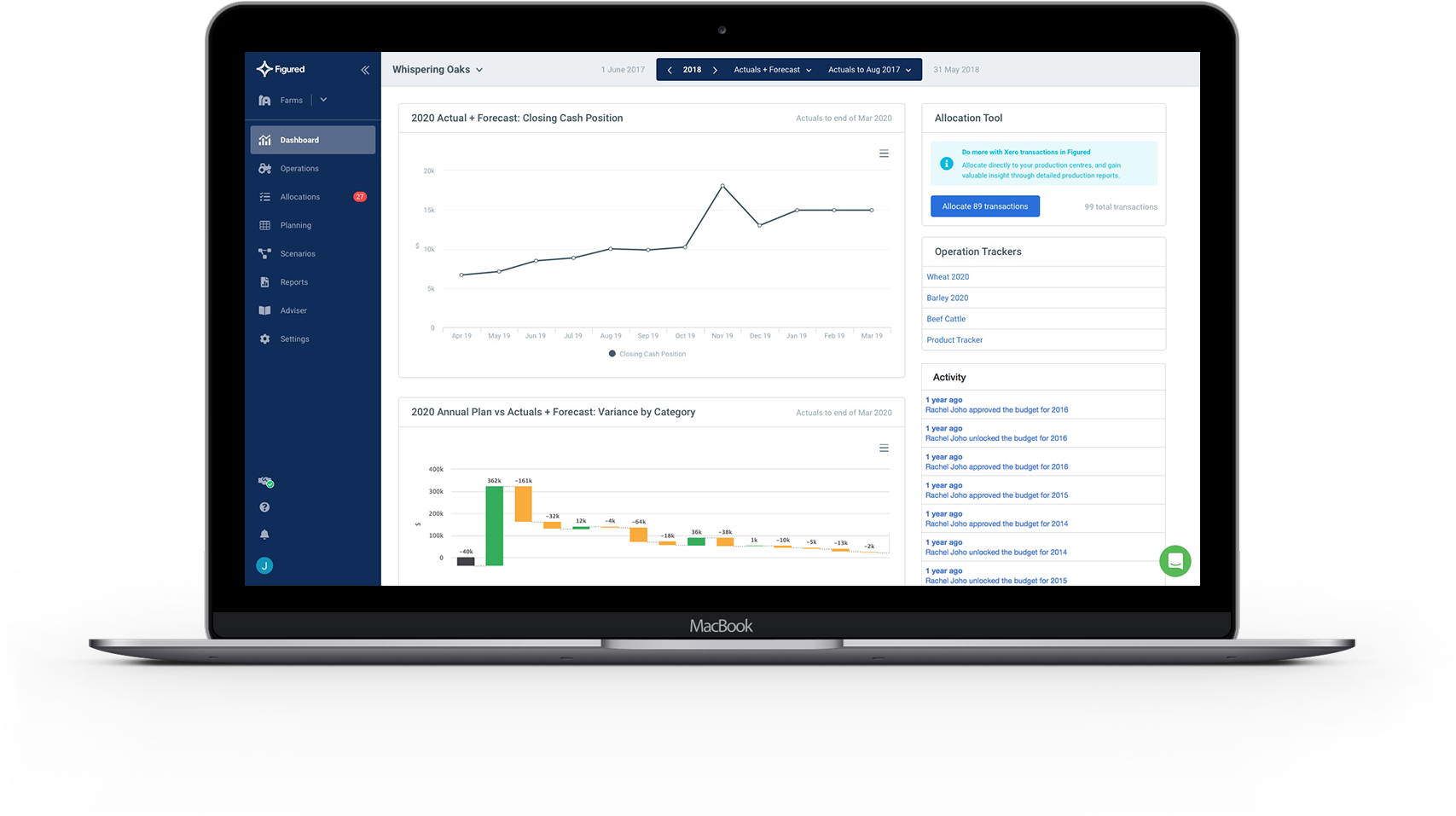

View the same locked-down budget that is used by both the farmer and the accountant, and easily compare actuals to budget.

Better manage the volatilities of the industry. Immediately adapt to challenges and changes in commodity prices throughout the season.

View consolidated reporting for multi-farms and eliminate inter-entity transactions to view true profitability of multi-entity organisations.

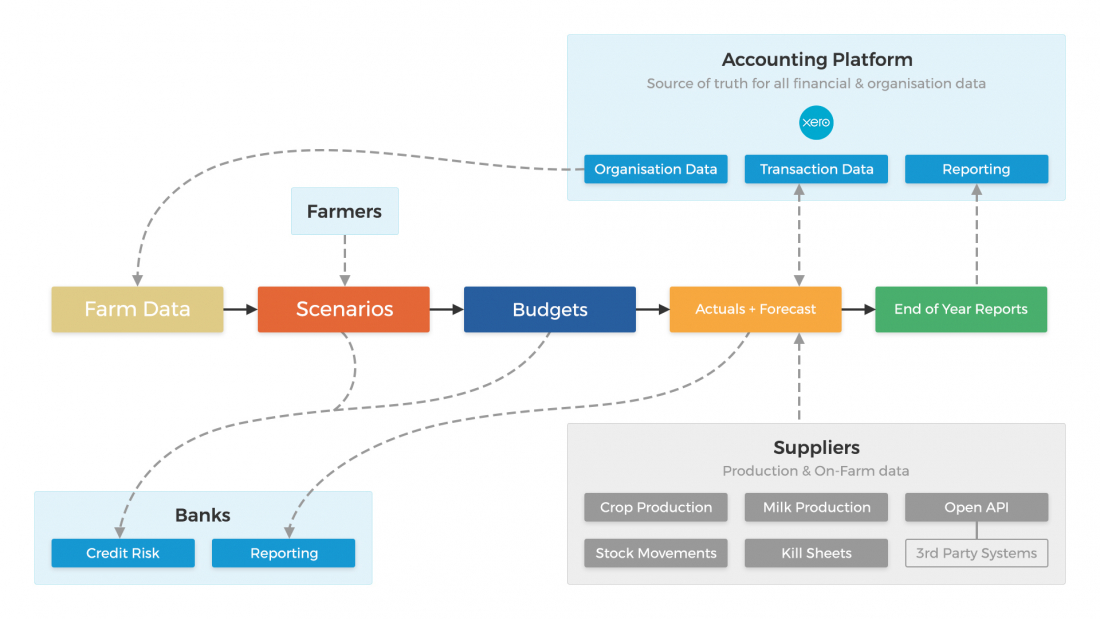

Figured syncs actual transactions with Xero which are categorised by the accountant, so you can have confidence in the accuracy of the numbers.

With access to customers’ actual farm data in Figured, you’ll view financials in real-time, and always be working with the most accurate and up to date numbers.

With easy to obtain and timely financial data, including milk payout pricing, you’ll have confidence in the accuracy of the data for more efficient credit decisions.

With a clear financial plan in place, you can easily log in and view how customer financial performance is tracking against their budget.

With a clear picture of cash position, you can present opportunities and help your customer look ahead for business growth.

Buy? Sell? Expand? Assess different opportunities quickly, see how a business may look several years ahead and push credit applications automatically into credit risk systems.

We’ve already partnered with several leading banks in New Zealand, Australia and the USA who believe in power of a connected farming team.

The easiest way to find out more about working with us is to drop us a message in the green bubble in the corner of your screen, or send us an email using the link below.

The Figured online Help Centre provides comprehensive resources to help you get started, as well as guidance on training and troubleshooting.

A live Figured training webinar provides you with the opportunity to learn more about the features of Figured and to chat to our team about any questions you have.